Giannis Antetokounmpo NBA Trade Rumors: Odds, Teams & Next NBA Destination

Giannis Antetokounmpo’s time with the Milwaukee Bucks is over. Not officially, mind you, while even a recently released interview by the New York Times sparked newfound hope that he may not leave Mil-town.

However, closer inspection of what The Greek Freak actually says in that interview, as well as what he’s been saying for months now, suggests a trade is just around the corner.

It’s still anyone’s guess as to who Giannis Antetokounmpo’s next team will actually be, or even when he will get traded. The speculation has run wild when it comes to these NBA trade rumors, and unless Thursday’s NBA trade deadline comes and goes without a deal being dropped, the buzz won’t stop.

DraftKings has a futures bet up right now for where his next regular-season minute will be played following the 2025-26 trade deadline. That begs two questions to be answered: will Giannis Antetokounmpo be traded, and where will he go if he’s dealt?

I’ll break down the latest Giannis Antetokounmpo trade odds and analyze how likely he is to be moved, and which team makes the most sense in a prospective deal.

Latest Odds for Giannis Antetokounmpo’s Next Team

| NBA Team | Odds of Rostering Giannis After Deadline |

|---|---|

Milwaukee Bucks | -160 |

Minnesota Timberwolves | +250 |

Golden State Warriors | +600 |

Chicago Bulls | +700 |

Miami Heat | +900 |

New York Knicks | +1600 |

Portland Trail Blazers | +2200 |

Philadelphia 76ers | +3000 |

Cleveland Cavaliers | +3000 |

Toronto Raptors | +3500 |

These are the teams with the best odds of trading for Giannis Antetokounmpo, while the Bucks are still favored to be the one to hold his rights once the NBA trade deadline has passed.

It’s an interesting betting market, simply because Giannis not being moved by the deadline doesn’t necessarily mean he doesn’t get traded this offseason. However, DraftKings explicitly lists it as a wager for just the 2025-26 NBA season.

That means whoever you pick for Giannis Antetokounmpo’s next NBA team, he has to play for them this year. This could be problematic, seeing as the Bucks have an incentive to find the best deal possible, and numerous teams that have serious interest have told them that they can sweeten the deal during the offseason.

Multiple teams are trying to convince the Bucks to wait until this summer to trade Giannis so they can send better offers, per @SIChrisMannix.

— Legion Hoops (@LegionHoops) February 4, 2026

While that may be true, Milwaukee’s leverage for the best possible deal could dry up before then. Giannis has also been public about not wanting to waste time and having a desire to contend right now. At age 31, who could blame him?

So, unless he signed off on the team tanking behind closed doors, he’d almost definitely want to return from his current calf injury and play after the NBA All-Star Break.

That has the makings of two ships passing in the night and going in very different directions. Still, there’s really good value with a lot of these Giannis trade odds. Either you believe he’s definitely staying put and you can hammer the Bucks at -160, or you can take a shot at plus money with anyone else that makes sense.

But which teams have a legit chance of trading for Giannis this season? I’ll break down the top contenders, my favorite sleeper pick, and end with my final Giannis Antetokounmpo trade prediction.

Why the Bucks Are Favored to Keep Giannis

Sometimes the markets price themselves. There is so much uncertainty surrounding this situation, as every single person attached to it is difficult to trust.

Milwaukee head coach Doc Rivers has said Giannis isn’t going anywhere, and Giannis himself dropped some compelling quotes in his recent interview that could be twisted as him saying he’s not leaving.

Giannis Antetokounmpo on if he would commit to another season with the Bucks if they were able to get back into position to win consistently

“You’re saying that if they can convince me to stay within the team, and the next year that we can compete? Oh yeah, 1,000 percent,”… pic.twitter.com/tPqeWcCsWZ

— Fullcourtpass (@Fullcourtpass) February 4, 2026

But a closer look might suggest that Rivers is simply delivering coachspeak and that Giannis is reflecting on the past more than he’s looking to the future when discussing the Bucks.

Favorites don’t always win, either, while a -160 price is nice if it pans out, but it’s far from a lock.

The reality is Milwaukee is well below .500, and they’re not even a playoff team as I write this, much less a title contender. The Bucks have tried ad nauseam to satisfy Gianni,s and still this is where they wound up – in salary cap hell with no clear path to title contention in sight.

Milwaukee could convince Giannis to stay by saying they’ll tank this year, offload bad contracts, and rebuild this summer. But there’s no guarantee that work,s and waiting only risks losing further leverage in Giannis trade talks.

The Bucks are an appealing bet at -160, and there is a chance he does get moved in the offseason, but this isn’t where I’d be investing my money with this betting market.

Top Contenders to Trade for Giannis

There are only four teams with odds better than +1000 to land Giannis Antetokounmpo, so it only makes sense that we should spend a little time on them.

Let’s do some quick vetting as to why these could be Giannis Antetokounmpo’s next team:

Minnesota Timberwolves (+250)

The Timberwolves have emerged as the top non-Bucks favorite to trade for Giannis. I can see it, as they have a win-now mentality and have a loaded roster. They are a deep and balanced team around ascending superstar Anthony Edwards, but they’re not quite at OKC’s level just yet.

Naturally, a big swing like this has the chance to put Minnesota at the forefront of the NBA Finals conversation. If they aren’t good enough as they stand, then why not give it a go, right?

The problem is there is a hangup as far as what the Bucks want and what Minnesota will give up (or even has).

Minnesota lacks the draft picks necessary to complete a deal like this, and reportedly are not too keen on the idea of giving up star 3-and-D swingman Jade McDaniels.

Bucks want Jaden McDaniels, multiple first-round picks in potential Giannis deal from Wolves, per @SIChrisMannix.

Without getting another team involved, Minnesota has no firsts to trade at deadline, could only offer 1 unprotected first-round swap in 2028.

— Underdog NBA (@UnderdogNBA) February 4, 2026

I tend to think he is very much worth sacrificing to land a top-5 NBA stud, but Minnesota may not budge. The other issue is due to the lack of picks; they may have to sacrifice a good amount of their depth in a deal like this.

That could include any of Naz Reid, Rudy Gobert, or Julius Randle. Suddenly, a deep and balanced team could be a two-man show that arguably got worse.

Due to so many question marks, the T’Wolves aren’t my top pick despite their current odds.

Golden State Warriors (+600)

This is the first one that makes some sense. Golden State is very much in win-now mode with star point guard Steph Curry only getting older, and they’ve been heavily involved in trade discussions.

Would landing Giannis move the needle for a 27-24 team that isn’t even presently a lock to make the playoffs? Considering the Warriors would probably have to sacrifice some of their depth to make a deal possible, it’s a fair question.

That said, Golden State badly wants this to happen, so much so that star forward Draymond Green seems to already have his bags packed.

Draymond Green on possibility that was his last game with the Warriors: “If it ends, what a f****** run it has been.”

He said he would not be “upset” if they trade him “if that’s what’s best for this organization.” pic.twitter.com/lhCx8OTfst

— Anthony Slater (@anthonyVslater) February 4, 2026

Green could be part of the solution in getting Giannis into the Bay Area, while the Warriors would have to give up a boatload of draft picks to incentivize the Bucks taking the bait.

Long-term, this is a bad landing spot for Giannis. But if he wants to contend immediately this year and next, it could be a destination that works for all parties involved.

Chicago Bulls (+700)

The Bulls have good odds to trade for Giannis, but this one seems unlikely. Chicago is below .500 at 24-27 at the time of this writing, so they’re not a whole lot better off than the team Giannis is currently on.

Chicago has some nice pieces to work with, but they aren’t close to contending, and any trade from Giannis would probably gut their roster. The team just traded away top center Nikola Vucevic, too, which likely further removes them from being a realistic trade partner.

Or it could be clearing room for a Giannis trade. After all, the Bulls should have plenty of reasons to facilitate this deal. They’ve been drowning in the murky waters of mediocrity ever since Derrick Rose left, so making a splash move for a superstar might be their only path back to relevance.

Chicago also has the draft capital to make a big move like this. They can get more value back by sending Coby White and others away in trades, while establishing their core with Giannis, Josh Giddey, and Matas Buzelis if he isn’t part of the trade.

Is that a title-contending core? Probably not. But it’s a start, and it’s not solely about which Giannis landing spot makes most sense for the player. Milwaukee could get a fat return in a trade with the Bulls, while Chicago could always convince Giannis to stay long-term in the house that Michael Jordan built.

It’s fun to think about and with +700 odds, and clearly somebody has been throwing money on Giannis to the Bulls. That said, this is easily the only Giannis trade destination that feels like a total waste of time for bettors.

Miami Heat (+900)

Next up are the Miami Heat, who arguably offer the most compelling mixture of young players and picks. Giannis has reportedly also been high on Miami as a landing spot, and the Heat have been aggressive in trade talks for months now.

Miami offers a really nice price for bettors considering how much of a chance they have of being Giannis Antetokounmpo’s next NBA team. There was admittedly a report recently that suggested they have broken off talks and will focus on other trades, of course:

The Heat have already changed course away from Giannis Antetokounmpo and are pivoting to other options, per @BrettSiegelNBA

(https://t.co/BDuyHcvaqk) pic.twitter.com/7gklmSAOux

— Fullcourtpass (@Fullcourtpass) February 4, 2026

If that’s actually true, then it could mean the Bucks simply have a better offer elsewhere that Miami can’t match or refuses to.

There has been a framework for a potential Giannis Heat trade, which likely starts with future picks and Milwaukee getting Tyler Herro, Kel’el Ware, and perhaps Terry Rozier to make the salaries align.

That is a strong deal for Milwaukee, and yet it wouldn’t take so much away from a deep Heat roster that Giannis couldn’t contend there right away. As far as appeasing both sides, this is undeniably the most attractive Giannis landing spot.

Other Contenders to Land Giannis Antetokounmpo

- New York Knicks (+1600)

- Portland Trail Blazers (+2200)

- Philadelphia 76ers (+3000)

These three teams are also in the mix and offer supreme betting value as longshots that may have a better chance than most people think.

New York has been salivating over the idea of trading for Giannis since last year. In fact, media pundits have been talking about a Giannis exit and aligning the stars to send him to MSG for years now.

How real it is remains to be seen, but the Knicks have a loaded roster that would make a trade very easy to figure out. The big issue would be draft pick compensation and which pieces the Bucks would want to pry away from New York.

Portland is also extremely interesting, as there is a lot of chatter about Giannis liking the idea of teaming back up with old teammates Damian Lillard and Jrue Holiday. Both are members of the Trail Blazers, while the team has a really nice young core with emerging stars such as Deni Avdija, Donovan Clinga, Shaedon Sharpe, and Scoot Henderson.

If any team is equipped to unload impressive talent in an effort to expedite their rise to contending status, it’s Portland.

Lastly, let’s not ignore the 76ers. Philly is another team with a lot of talent and depth, but they could still be one key piece from being the true favorite in the Eastern Conference.

Just imagine Giannis standing next to Joel Embiid and Tyrese Maxey gunning defenses on every possession. That is one sick trio that could be impossible to stop.

All it’d take to get a deal done? Dangling star rookie VJ Edgecombe, some more prospects, and some picks. Philly is absolutely a dark horse contender, as they fit the Giannis championship window, they have the tools to make a deal happen, and they have extremely favorable odds for bettors willing to take a risk.

The Top Sleeper Team to Trade for Giannis

Not getting enough value with all of these other possible Giannis Antetokounmpo landing spots? Then let’s go even bigger with the Oklahoma City Thunder. The defending champs have struggled with health and consistency a bit more than anyone thought they would, but as the top team in the NBA, they are clearly in play to repeat as league champs.

There are negative optics for Giannis here. He’d be joining a team literally coming off of a championship, so it’d be a dent in his legacy. However, OKC has draft picks, and they have gobs of interesting talent they can throw at the wall.

The Thunder could dangle Jalen Williams or Chet Holmgren in Giannis trade talks, moving from the most likely champion to a team virtually nobody has a chance against.

Obviously, the problem is that OKC may not see the point of messing with their chemistry. The roster they have is the one they built and won with, after all. Nothing we’ve seen this year really suggests they aren’t still the team to beat, either.

The Longshot Team to Land Giannis

Even if you’re betting on Giannis to stay with the Bucks at -160, you’re getting value. If you bet on any other team to trade for him and end up being right, you’ll more than double your money.

There is also a chance this is all for nothing, so taking a blind shot on a wild option simply might make life a bit more fun. If you go that route, consider doing it with the Denver Nuggets.

Denver is already in position to contend this year. The duo of Nikola Jokic and Jamal Murray has them closing in on second place in the Western Conference, but they still are a distant second to the Thunder, along with everyone else.

The Nuggets have some solid pieces they could send Milwaukee’s way, especially with youngster Peyton Watson emerging recently. On top of some nice players they could include in any prospective Giannis trade, the Nuggets have a few picks to include, but may need a third team to assist in a deal.

Of course, the point here is two-fold: the Nuggets are right there in terms of contending, and their +10000 odds are pretty alluring. Now it just comes down to them shocking the world.

Where Will Giannis Antetokounmpo Play Next?

Now comes the time for a final Giannis Antetokounmpo prediction. Milwaukee’s price keeps moving. Seriously, when I started writing this, they were a -135 favorite, and now they’re up to -160. That means people are betting on them enough to boost their line, and the betting public is forming a consensus that he isn’t getting traded before the deadline.

The New York Times interview and countless Giannis trade rumors being leaked have swayed bets, but I am sticking to my guns and saying I think he gets dealt. The only question is where?

Ultimately, the Bucks need to leverage what they have in their possession: a top-5 superstar with two years on his deal. If they wait to move him until after the trade deadline, his value drops, however, as it goes from two playoff runs worth of Giannis to him being a one-year rental.

If we’re looking at the big picture from all angles, I think all roads lead to the Miami Heat. They give Giannis a clear path to winning, a strong head coach, a front office committed to seeking championships, and he gets to stay in the East.

For Giannis, the Heat are a big win, and a long-term deal is also going to be on the table.

It’s a huge play for Miami, who are just 27-25, but are a bit better than their record shows. They are also the perfect team for a Giannis-led offense, as he takes care of business inside and when the defense collapses, their murderer’s row of outside shooters make opposing teams pay.

On the other side, the Bucks should come away plenty pleased, too. Tyler Herro and Kel’el Ware headline a solid trade in terms of talent going north, but the Heat also own their own first round draft pick this year, as well as 2029, 2030, 2031, and 2031.

The only question is the asking price. Are the Bucks demanding all of Miami’s young talent and all of their picks? Probably. Depending on what the true hangup is and how badly Miami wants Giannis, we could have a problem.

But winning doesn’t have a price. I think Pat Riley caves in the end, gives the Bucks a king’s ransom, and all sides walk away happy. It’ll be the end of an era, and it’ll be sad to see Giannis in another jersey, but anyone willing to slap a bet on the Heat at +900 probably won’t care.

Super Bowl MVP Odds with Top Picks & Prediction

Super Bowl 60 is less than two weeks away. Betting on the Big Game is a tradition unlike any other, and predicting who will win the Super Bowl MVP award goes right into that.

Except, this is usually one of the safest bets you can place on the Super Bowl. Quarterbacks almost always win Super Bowl MVP, so the only thing you really need to do is decide which team will win.

The New England Patriots and Seattle Seahawks will square off in the 2026 Super Bowl, meaning all eyes will be on quarterbacks Sam Darnold and Drake Maye. While history suggests one of them will win the Super Bowl MVP, bettors need to either decide which one, or bet on something crazy happening.

To dive into it, let’s look at the latest Super Bowl MVP odds. Who is the Super Bowl MVP favorite, the top contenders, and some sleeper bets? I’ll go over it all, point you to the best bets for the market, and cap things off with a final Super Bowl MVP prediction.

Current Super Bowl MVP Odds for 2026

| Player | Super Bowl MVP Odds |

|---|---|

Sam Darnold, QB, Seahawks | +125 |

Drake Maye, QB, Patriots | +235 |

Jaxon Smith-Njigba, WR, Seahawks | +550 |

Kenneth Walker III, RB, Seahawks | +650 |

Rashid Shaheed, WR, Seahawks | +2800 |

Marcus Jones, CB, Patriots | +5500 |

Stefon Diggs, WR, Patriots | +6000 |

TreVeyon Henderson, RB, Patriots | +7500 |

Drew Lock, QB, Seahawks | +7500 |

Ernest Jones IV, LB, Seahawks | +7500 |

These are the top 10 players in terms of Super Bowl 60 MVP odds. They are the best bets to win the award, but that definitely doesn’t mean bettors should stop here.

Still, quarterbacks almost always win the Super Bowl MVP, so starting with Sam Darnold vs. Drake Maye is wise. Looking back, a quarterback has claimed the hardware from the winning side in each of the last three seasons and eight times since 2015.

It's been NINE consecutive years that we've seen a QB or WR win Super Bowl MVP – Is another position destined to win it in Super Bowl LX? 👀 pic.twitter.com/LAVBTBf3TD

— theScore Bet (@theScoreBet) January 27, 2026

It is not necessarily as much of a “quarterback award” as the regular-season NFL MVP award tends to be, but if the quarterback has a good game and his team wins, he will most likely be the winner.

However, where value can arise is when there is a potential defensive battle and/or if there are skill position players with huge performances. This game offers paths to both of those, meaning while Darnold and Maye stand out as the top picks, they’re not the only players worth betting on.

I’ll go over the most viable Super Bowl MVP betting candidates, but first, let’s break down why Sam Darnold is the favorite for this year.

Why is Sam Darnold the Super Bowl MVP Favorite?

The easiest answer for this question is that Darnold is the quarterback for the team currently favored to win Super Bowl XL.

Darnold has a really strong narrative backing him, even besides that, though, as he’s had an amazing season. Even more important, of course, is his label as a former draft bust.

The New York Jets made Darnold the top pick in the NFL Draft back in 2018, and things did not work out with the franchise. Darnold then bounced around the league and seemed to be on his way out before resurrecting his career last year with the Minnesota Vikings.

Minnesota tossed him aside, and he was forced to once again start over with Seattle. Luckily for him, he churned out his second straight stellar campaign and is now in a position to complete a full 180 on his NFL career.

Needless to say, it will be extremely hard for the Super Bowl MVP voters to bypass him if his team wins and he has even a small hand in it.

Should Darnold play well and Seattle emerge victorious, it would be a shock if he didn’t get the award. In fact, it would probably require an outlier performance by someone else on his team, and/or a very weak statistical output from him.

That is not impossible, however, which is why anyone looking to bet on the Super Bowl MVP winner needs to turn over every stone.

Is Darnold the rightful favorite? Yes. He’s also a stellar value, all things considered, but let’s consider all options before dropping a Super Bowl MVP prediction.

Top Super Bowl MVP Contenders

- Drake Maye, QB, Patriots (+235)

- Jaxon Smith-Njigba, WR, Seahawks (+550)

- Kenneth Walker III, RB, Seahawks (+650)

Sam Darnold is the favorite to win the 2026 Super Bowl MVP award, but not by much. Right behind him is Patriots quarterback Drake Maye, who is following in Tom Brady’s footsteps.

There’s also JSN and Kenneth Walker III, two players on the favored Seahawks who have displayed explosive upside. If they outshine Darnold in a win, they could easily get the nod.

These are your main Super Bowl XL MVP contenders, and they’re the only players coming in below +1000. Here’s a breakdown of each and why they can win the MVP award:

Why Drake Maye Can Win Super Bowl MVP

Maye can make even more interesting history, as a win would make him the youngest Super Bowl-winning quarterback in NFL history. Adding the MVP trophy would be a nice bonus, and at +235, he looks like a legitimate threat to do so.

What needs to happen? First, the Pats need to beat the Seahawks. Second, Maye probably needs to be the reason why New England wins. Making that happen could actually be more difficult than expected, too. Not only are the Patriots running into an elite Seattle defense, but Maye will need to have one of the best games of his life despite not being 100%.

Is Drake Maye surprised by all of the conversation about his shoulder?

"I mean, it's the right shoulder of a starting quarterback of an NFL team."

He gets it pic.twitter.com/lRymXwH99l

— Nicole Menner (@NicoleMenner) January 29, 2026

Maye is dealing with a shoulder injury that until now hasn’t generated a lot of buzz. That’s another thing that aids his case. If Maye balls out, he looks even better. If he simply guts out a tough performance and his team wins a low-scoring defensive battle and nobody else shines, he’d be the MVP almost by default.

New England hasn’t looked good on offense in their playoff run. You could argue that they’ve won these games despite Maye and the offense’s performance. But if their defense stifles Seattle and Maye doesn’t shoot himself in the foot, he’d still be the likely MVP winner.

Why JSN Can Win Super Bowl MVP

Jaxon Smith-Njigba has enjoyed an insane third NFL season. The second you thought he flashed his ceiling in 2024, he blew you away with a disgusting 119-1,793-10 stat line.

The only thing JSN can do for an encore is go crush in the biggest game of his life. He just did that against the Rams in the NFC title game, where he hauled in 10 passes for 153 yards and a score.

Jaxon Smith-Njigba caught 10 of 12 targets for a team-high 153 receiving yards and a TD against the Rams.

JSN caught at least one pass against six different Rams defenders in coverage, and caught all 6 targets for 105 yards when aligned out wide.#LARvsSEA | @Seahawks pic.twitter.com/28SFLsbelN

— Next Gen Stats (@NextGenStats) January 26, 2026

Smith-Njigba is borderline uncoverable. He has a stiff test ahead of him against Christian Gonzalez, but he has the speed and jaw-dropping route-running to gain separation even in the toughest of spots.

Wide receivers can win the Super Bowl MVP award, too. We just saw Cooper Kupp do it a few years ago with the Rams, while Julian Edelman and Deion Branch won it for the Patriots in previous seasons.

Behind quarterbacks, the wide receiver position has racked up the most MVP wins in the Super Bowl. JSN could be next.

Why Kenneth Walker III Can Win Super Bowl MVP

The other compelling Super Bowl MVP contender is Seattle running back Kenneth Walker III. It’s not necessarily about building a strong case in his favor, but more about creating a narrative in the event the award doesn’t go to a quarterback.

If the Super Bowl MVP winner isn’t one of the quarterbacks and JSN doesn’t nab it, then we could be looking at a situation where the defenses dominate or a running back goes off.

Walker has flashed special ability, as he teed off on the San Francisco 49ers (3 TDs) a few weeks ago.

KEN WALKER III LEGACY GAME:

– 22 Touches

– 145 Yards

– 3 TD’sHe looked electric today, averaging 6.1 Yards Per Carry..

Seattle’s headed to the NFC Championship after their 41-6 Win over San Francisco

Pure dominance from start to finish pic.twitter.com/riuAjbDWJf

— Austin Abbott (@AustinAbbott) January 18, 2026

New England’s run defense is solid, but they can still give up some production, and if Walker hits home run plays like he’s capable of, their rankings against the run could ultimately be meaningless.

Someone is going to dominate this game. If someone from the passing game doesn’t, then banking on Walker popping off for some big gains and being the catalyst for a Seahawks win is an interesting way to bet on this market.

5 Sneaky Super Bowl MVP Sleeper Picks

- Rashid Shaheed (+2800)

- Stefon Diggs (+6000)

- TreVeyon Henderson (+7500)

- Cooper Kupp (+9000)

- Christian Gonzalez (+10000)

Want to seek out even more betting value for this market? You certainly have options in front of you. But if you want a sleeper bet that makes sense, I’d start with the five guys listed above.

First, there’s Shaheed. He isn’t very involved in Seattle’s offense from a volume perspective, but he has the speed to take any touch to the house and could easily make his presence felt in the return game.

Shaheed is a very interesting Super Bowl MVP sleeper pick, although I wish he had more appealing odds.

Someone like Diggs is more interesting at a +6000 price tag. Diggs has had an up-and-down career and has changed teams a handful of times. He could finally have his shining moment on the biggest stage of his career, and if he shows out, he just might take home the hardware.

The same could be said for guys like Henderson or Kupp. Henderson is a pivot away from Kenneth Walker III. We can use that same logic and apply it to the explosive rookie back, albeit with a much more alluring price.

Kupp is a greybeard whose best days are admittedly behind him, but he has a Super Bowl MVP in his back pocket already.

He also may be called upon more than you’d think, especially given New England’s elite secondary. Could the Pats go so far out of their way to slow down JSN that Kupp racks up catches and makes a huge impact? It’s not impossible.

Lastly, let Christian Gonzalez represent all of the possibilities via any defensive players in this Super Bowl. He stands out due to his price, plus the task ahead of him. If he can successfully slow down JSN in a low-scoring game, he could get the nod. He would improve his chances even more if he can nab a pick from Darnold, while a pick-6 would cement it.

Darnold is known for turning the ball over, and this game features the top two defenses in the NFL, so a defensive Super Bowl MVP winner isn’t that crazy.

Who Typically Wins the Super Bowl MVP?

| Position | Super Bowl MVP Awards Won |

|---|---|

Quarterback | 33 |

Wide Receiver | 8 |

Running Back | 7 |

Linebacker | 4 |

Defensive End | 2 |

Defensive Tackle | 2 |

Safety | 1 |

Cornerback | 1 |

Kicker | 0 |

Tight End | 0 |

As noted before, this is basically a quarterback award, and it’s been more so the case over the last 20 years.

Still, other positions can win, depending on how the game plays out. Here are things to consider when looking at game flow and expected result:

- Huge statistical performances

- Surprise x-factors

- Low-scoring defensive battles

- Momentum-swinging plays

This is actually the exact type of Super Bowl matchup where we want to consider how and why an outlier would make sense.

We have the two best scoring defenses in football, two very good units at preventing big plays, and two offenses that thrive off of splash plays. It creates a really tough environment to project, so while betting on the QBs remains the safest path, taking stabs at seemingly random bets makes a lot of sense.

Avoiding defensive players in general is still probably wise, but given the makeup of this particular matchup, you can’t completely rule it out.

That said, based on history, quarterbacks are most likely to win, followed by wide receivers and running backs. Never say never, but kickers and tight ends are a waste of your time. You can take your shots on defensive players, though.

Super Bowl MVP Betting Tips

Okay, so you’re ready to bet on who will win the Super Bowl 2026 MVP award. You should have a good amount of information to nudge you in the right direction, but consider these tips before finalizing your bets:

- Quarterbacks Usually Win

- Game Script is Everything

- WRs > RBs for Outlier Bets

- Defensive MVPs Require Chaos

- Narrative > Boxscore

Quarterbacks win this award most of the time, so plan most of your Super Bowl MVP bets accordingly. That doesn’t mean you should ignore certain context, but if a game sets up for either quarterback to have success, your main goal then becomes nailing the one who wins.

It’s not easy to predict how games will go in the NFL, but projecting things is key to identifying the right MVP pick. This is especially important for non-QB bets. If you’re betting on a specific player, ask yourself how many things need to go right in order for them to win. How much of an outlier does their performance need to be?

When going against the grain, start with the positions that make the most sense after quarterback. Based on history, that’s wide receivers, then running backs. Wide receivers have easier paths to racking up gaudy stat lines, as receptions are valued higher than rushing attempts.

The real trick – especially for a game like Super Bowl 60 – is gauging how likely it is that a defensive player could win. Then consider what their path to winning would be, and what goes into that route. Defensive stats and scores are key, while momentum-swinging plays can offer momentum to obscure players.

Lastly, don’t forget about narrative. It’s the lifeblood of sports in general, so while all players start out with a chance to win the Super Bowl MVP, a few have stronger narratives to fall back on.

For instance, Sam Darnold, Cooper Kupp, and even Stefon Diggs have redemption arcs. Drake Maye could become the youngest Super Bowl-winning quarterback of all time, and on it goes.

Recent Super Bowl MVP Winners

| Year | Super Bowl MVP | Position |

|---|---|---|

2025 | Jalen Hurts | Quarterback |

2024 | Patrick Mahomes | Quarterback |

2023 | Patrick Mahomes | Quarterback |

2022 | Cooper Kupp | Wide Receiver |

2021 | Tom Brady | Quaterback |

2020 | Patrick Mahomes | Quaterback |

2019 | Julian Edelman | Wide Receiver |

2018 | Nick Foles | Quaterback |

2017 | Tom Brady | Quaterback |

2016 | Von Miller | Linebacker |

Who Will Win the Super Bowl MVP in 2026?

You know what the likely path to the Super Bowl MVP is. Quarterback dominates this award, the winning team’s passer gets the nod, and narratives are a big deal. Due to these things, if the Seahawks live up to their status as this year’s Super Bowl favorite, I think Sam Darnold walks away with the hardware.

Darnold is a former #2 overall draft pick, and while he flamed out with the New York Jets, the talent was always there. It took a while for him to be fully tapped into, but the player we’ve seen the last two years is borderline elite.

From a talent and narrative perspective, Darnold passes the eye test. And he happens to be on the best team. He can carry Seattle if he has to, but thanks to an explosive ground game, a superstar wide receiver, and a smothering defense, that may not end up being the case.

There’s still some wiggle room for obscure players to rise up and win bettors a lot of money. But if we approach this year’s Super Bowl MVP betting market appropriately, there’s only one answer.

2026 Super Bowl MVP Prediction: Sam Darnold (+125)

Top 10 Prediction Markets to Watch in 2026

Prediction markets are no longer a fringe curiosity for political junkies or crypto diehards. They’re quietly becoming one of the most accurate—and controversial—ways to forecast the future. And in 2026, they’re sitting at a crossroads.

At a glance, prediction markets look simple: people buy and sell contracts based on what they think will happen. But under the surface, they’re doing something far more powerful. They aggregate belief, information, incentives, and timing into a single price—often beating polls, pundits, and even expert models.

That’s why regulators are nervous. It’s why sportsbooks are paying attention. And it’s why traders, bettors, and analysts are starting to treat prediction markets less like a novelty and more like a signal.

But here’s the catch: not all prediction markets are worth your time. Some are liquid and sharp. Others are thin, confusing, or restricted. A few are shaping the future of event trading. Most won’t survive the next regulatory or market cycle.

This guide breaks down the 10 prediction markets that actually matter heading into 2026—where the smart money is watching, what’s changing fast, and how to tell signal from noise before everyone else catches on.

How We Ranked These Prediction Markets

Prediction markets live or die on structure, not hype. A clever contract on a bad platform is still a bad market. That’s why this list isn’t ranked by brand recognition alone—or by how exciting the markets look at first glance.

Instead, we evaluated each platform the same way an experienced trader or bettor would: by asking whether it actually delivers usable signal, fair pricing, and a realistic way to participate without unnecessary friction.

Here’s what mattered most in our rankings:

- Liquidity & market depth – Can you get in and out without moving the price? Tight spreads and consistent volume matter far more than flashy market ideas.

- Market quality & clarity – Are contracts clearly worded? Are outcomes unambiguous? Vague resolution rules are one of the fastest ways to lose money.

- Settlement & dispute process – The best platforms obsess over how markets settle—what sources are used, how edge cases are handled, and what happens if reality doesn’t fit neatly into a yes/no box.

- Regulatory access & reliability – A great market doesn’t help if you can’t legally trade it where you live, or if it can disappear overnight due to enforcement pressure.

- User experience & friction – This includes onboarding, KYC, wallet setup (if applicable), order placement, mobile usability, and withdrawal speed.

- Innovation & forward momentum – We favored platforms that are expanding market types, improving tooling, or positioning themselves for broader adoption in 2026—not ones standing still.

In short, this ranking reflects where informed users can realistically trade, learn, and extract signal today—while still keeping an eye on what’s coming next.

Top 10 Prediction Markets to Watch in 2026

2026 is shaping up as a breakout year for prediction markets. Some platforms are becoming more mainstream and regulated, others are innovating with new market types or decentralized infrastructure, and a few are quietly building deep liquidity in niche categories. Whether you’re a seasoned trader, a bettor, or just curious about where crowd forecasts intersect with real-world outcomes, these are the markets worth your attention.

Below each entry you’ll find clear, bite-sized insights and concrete reasons why it matters — plus suggestions for visuals that boost reader understanding and retention.

1) Kalshi — Regulated U.S. Event Contracts

A U.S.-regulated prediction market turning real-world events into tradeable contracts. Kalshi is where prediction markets are colliding head-on with regulators—and going mainstream.

Why It’s a Must-Watch

- U.S. CFTC-regulated contract exchange

- Expanding beyond politics into economic and weather outcomes

- Growing interest from mainstream traders

Key Features

- ✔ Regulated and compliant

- ✔ Fiat rails (no crypto wallets needed)

- ✔ Clear settlement rules

What to Watch in 2026

- Sports-adjacent markets (if regulatory pressure eases)

- Liquidity growth on headline events

- State jurisdiction shifts

Best For

- Traders who want a regulated, transparent experience

2) Polymarket — Crypto-Native Prediction Trading

The most recognizable crypto-native prediction market, known for deep liquidity and headline-driven events. Polymarket often reflects real-time sentiment faster than polls or news.

Why It’s a Must-Watch

- One of the largest names in prediction markets

- Broad range of events from politics to culture

- Deep liquidity on major outcomes

Key Features

- ✔ Global access (where allowed)

- ✔ Live market feed with dynamic pricing

- ✔ Strong community participation

What to Watch in 2026

- Regulatory responses in key jurisdictions

- Liquidity on new categories (AI milestones, geopolitics)

- UX improvements to onboard non-crypto users

Best For

- Users comfortable with crypto wallets and DeFi

3) PredictIt — Political Market Mainstay

A long-running favorite for political forecasting with strict position limits. PredictIt remains a go-to platform during major U.S. election cycles.

Why It’s a Must-Watch

- High recognizability in political circles

- Simple, approachable UI

- Consistent during election cycles

Key Features

- ✔ Focus on U.S. political outcomes

- ✔ Low position limits (keeps markets accessible)

- ✔ Relatively stable rules

What to Watch in 2026

- Post-election volume trends

- Extensions into policy or governance questions

- Integration with analysis tools

Best For

- Political betting and forecast enthusiasts

4) Robinhood / LedgerX — Prediction Contracts in Brokerages

Traditional finance dipping into prediction-style contracts. If brokerages scale event trading, this could be the biggest distribution shift in the space.

Why It’s a Must-Watch

- Traditional brokerages experimenting with event contracts

- Opens prediction markets to millions of users

- Signals broader financial acceptance

Key Features

- ✔ Familiar UX for mainstream investors

- ✔ Potentially big distribution

- ✔ Tied to existing trading accounts

What to Watch in 2026

- Expansion of contract types

- Integration with mobile alerts

- Liquidity strategies

Best For

- Traders who prefer regulated brokerage environments

5) Manifold Markets — Play Money, High Signal

A play-money forecasting platform that still produces surprisingly sharp signals. Manifold is often where trends appear before they hit real-money markets.

Why It’s a Must-Watch

- Play-money markets that often predict real outcomes

- Excellent front line for trend discovery

- Huge variety of niche topics

Key Features

- ✔ Fun, low-risk learning

- ✔ Viral market creation

- ✔ Strong community

What to Watch in 2026

- Trends that later show up on real-money markets

- User growth in specific categories

- API integrations with analytics

Best For

- Beginners and trend scouts

6) Insight Prediction — Underrated & Growing

An underrated platform covering a wide range of real-world events. Insight Prediction is one to watch if liquidity continues to improve.

Why It’s a Must-Watch

- Covers politics, sports, and global events

- Less crowded than bigger exchanges

- Opportunity to find early liquidity

Key Features

- ✔ Wide event selection

- ✔ Clean UI

- ✔ Accessible outcomes

What to Watch in 2026

- Liquidity depth increases

- Partnership announcements

- Market expansion by category

Best For

- Exploratory traders seeking variety

7) Hypermind — Forecasting for Serious Analysts

A forecasting-focused market emphasizing accuracy over trading hype. Hypermind attracts analysts who care more about being right than being flashy.

Why It’s a Must-Watch

- Focuses on numeric forecasting rather than simple binary

- Attracts expert forecasters

- Signal quality is often high

Key Features

- ✔ Precision forecasting

- ✔ Multiple scenario markets

- ✔ Expert participation

What to Watch in 2026

- Application of forecasting models to real trading

- Academic and industry attention

- API output for professional tools

Best For

- Analysts and data-driven forecasters

8) Omen (Gnosis Ecosystem) — Decentralized, Flexible Markets

A decentralized prediction market built on Gnosis’ conditional tokens framework. Omen offers maximum flexibility—for users comfortable with DeFi friction.

Why It’s a Must-Watch

- Permissionless market creation onchain

- Rich variety of contract types

- Deep DeFi integration

Key Features

- ✔ Decentralized architecture

- ✔ Open to anyone to create markets

- ✔ Conditional tokens model

What to Watch in 2026

- UX innovations that lower UX friction

- Liquidity mining / incentive programs

- Cross-chain expansion

Best For

- DeFi enthusiasts and builders

9) Zeitgeist — Polkadot Prediction Protocol

An experimental prediction market ecosystem built on Polkadot. Zeitgeist is pushing new ideas in liquidity design and governance.

Why It’s a Must-Watch

- Built on Polkadot’s modular chain stack

- Experimental governance and market mechanics

- Strong Web3 roadmap

Key Features

- ✔ Advanced liquidity features

- ✔ Chain-native design

- ✔ Emerging governance tools

What to Watch in 2026

- Adoption curves

- Governance innovations

- Liquidity incentives

Best For

- Advanced users exploring next-gen markets

10) Augur — Legacy Protocol with Reboot Potential

One of the earliest decentralized prediction markets. Augur remains a legacy protocol to watch if reboot efforts successfully fix UX and liquidity issues.

Why It’s a Must-Watch

- One of the first decentralized prediction platforms

- Still referenced and forked across DeFi

- Community watching for UX and oracle improvements

Key Features

- ✔ Decentralized settlement

- ✔ Secure oracle mechanisms

- ✔ Protocol longevity

What to Watch in 2026

- UX improvements

- Oracle accuracy upgrades

- Renewed liquidity campaigns

Best For

- Long-term DeFi participants

How to Evaluate Any Prediction Market Like a Pro

Prediction markets reward people who evaluate market quality, not just outcomes. Two platforms can offer the same event, but the experience—and your results—can be wildly different depending on liquidity, wording, and settlement rules.

Before placing a single trade, sharp users run through a simple mental checklist.

1) Liquidity: Can You Enter and Exit?

Liquidity is the single most important factor in any prediction market.

A contract might look profitable, but if the order book is thin, you’ll pay for it through wide spreads or slippage.

What strong liquidity looks like:

- Tight bid-ask spreads (often just 1–2¢ on active markets)

- Consistent volume across price levels

- Ability to close a position without moving the market

Red flags:

- Huge gaps between buy and sell prices

- Volume concentrated in only one outcome

- Price jumps caused by small orders

Rule of thumb: If you can’t exit cleanly, you don’t really have a trade.

2) Contract Clarity: Does the Question Leave Room for Confusion?

Ambiguous contracts are where prediction markets quietly take money from new users.

Sharp platforms obsess over precise wording and edge cases.

Before trading, check:

- Exact phrasing of the question

- Timeframe and cutoff dates

- What source determines the outcome

- How partial or unexpected outcomes are handled

Common traps:

- Vague political phrasing (“wins,” “leads,” “controls”)

- Undefined data sources

- No guidance on postponements or cancellations

3) Settlement Rules: How Does This Actually Resolve?

Settlement is where theory meets reality—and where bad platforms fall apart.

The best markets clearly define who decides, how, and when.

Look for platforms that:

- Name official resolution sources upfront

- Publish timelines for settlement

- Explain dispute and appeal processes

Avoid markets where:

- Resolution depends on informal consensus

- Rules change mid-market

- Edge cases aren’t addressed

4) Fees & Friction: What’s the Real Cost of Trading?

Prediction markets often look cheap—until you factor in friction.

Evaluate the full cost:

- Trading fees or spreads

- Withdrawal fees

- KYC delays

- Wallet or gas fees (for crypto platforms)

Even small costs matter if you’re trading frequently or at scale.

5) Regulatory & Access Risk: Will This Market Still Exist Tomorrow?

A profitable market doesn’t help if it disappears overnight.

Ask yourself:

- Is this platform regulated, restricted, or operating in a gray area?

- Are users in your location allowed to trade?

- Has the platform faced enforcement action before?

Markets with regulatory clarity tend to:

- Offer better fiat on-ramps

- Provide clearer settlement rules

- Last longer through market cycles

6) Signal vs Noise: Is This Market Actually Informative?

Not every prediction market produces good signal.

Some reflect real information. Others reflect hype, ideology, or low-effort speculation.

Signs of high-quality signal:

- Prices adjust quickly to new information

- Liquidity grows around major updates

- Diverse participation (not just one crowd)

Signs of noise:

- Price stagnation despite news

- One-sided order flow

- Meme-driven volatility

Pro Takeaway

Great prediction market users don’t ask, “What do I think will happen?” They ask, “Is this a good market to trade?”

If you evaluate liquidity, clarity, settlement, friction, and signal quality first, you’ll avoid most of the traps that catch new traders—and you’ll start seeing prediction markets for what they really are: structured information systems with prices attached.

2026 Trends That Will Shape Prediction Markets

Prediction markets don’t evolve in isolation. They move alongside regulation, technology, and cultural acceptance. In 2026, a few forces are converging that will likely determine which platforms thrive, which stagnate, and which disappear altogether.

Regulation Will Remain the Main Battleground

The biggest story isn’t growth—it’s who gets to offer these markets, and where.

Regulators are still deciding whether prediction markets are:

- financial instruments,

- a form of gambling,

- or something entirely new that doesn’t fit existing frameworks.

What this means in practice:

- State vs federal tensions will continue, especially around event contracts

- Some platforms will pause or limit markets preemptively

- Regulated exchanges may gain trust, but move slower

Sports-Style Event Contracts Will Push Boundaries

Sports-adjacent markets are the fastest way prediction markets attract new users—and the fastest way they attract scrutiny.

These contracts feel familiar to bettors, but operate very differently under the hood.

Why this matters in 2026:

- Sports outcomes drive volume and attention

- The line between “forecasting” and “betting” gets blurry

- How regulators respond here will shape the entire industry

Weather & Climate Markets Will Gain Serious Attention

What once felt academic is becoming practical.

Weather, climate, and environmental outcomes are increasingly tradable—especially for hedging and forecasting purposes.

Expect growth in markets tied to:

- Extreme weather events

- Seasonal temperature ranges

- Climate policy milestones

- Energy and utility impacts

These markets attract non-speculative participants, which often improves signal quality.

Ethics, Information, and Insider Concerns Will Intensify

As prediction markets become more accurate—and more influential—the ethical questions get louder.

Key debates gaining traction:

- Who is allowed to trade on sensitive information?

- When does forecasting become influence?

- Should some markets exist at all?

Platforms will increasingly need clear guardrails to maintain legitimacy.

Traditional Finance Will Continue Moving In

Perhaps the most important long-term trend: prediction markets are being noticed by people with distribution.

When brokerages and exchanges experiment with event-style contracts, it signals validation—and pressure.

Why this matters:

- Mainstream UX expectations rise

- Liquidity could scale rapidly

- Smaller platforms may struggle to compete

2026 won’t be defined by whether prediction markets grow—but by how they mature. Platforms that balance clarity, compliance, and innovation will survive. The rest will be squeezed out by regulation, friction, or irrelevance.

Final Take: Where Prediction Markets Go From Here

Prediction markets are no longer just a novelty or a niche experiment. Heading into 2026, they’re evolving into real information markets—places where price often reflects reality faster than headlines, polls, or expert opinion.

But this space is still uneven. Some platforms are building deep liquidity, clear settlement rules, and legitimate pathways for mainstream users. Others are chasing hype without solving the fundamentals. Knowing the difference matters.

The smart approach isn’t to chase every new market—it’s to understand how these platforms work, why certain markets produce better signal, and where regulatory and structural risks still exist. That’s what separates casual speculation from informed participation.

If you’re new, start with clarity and accessibility. If you’re experienced, focus on liquidity and market quality. And if you’re watching from the sidelines, pay attention anyway—because prediction markets are quietly influencing how people think about politics, sports, weather, and even global events.

By the time prediction markets fully hit the mainstream, the edge will already be gone. The best position, as always, is early—but informed.

Who Will Win the Oscars Best Picture? Updated Odds & Market Breakdown

The 2026 Golden Globes are in the rearview mirror, which means it is officially Oscars season. Now that we have some hardware being handed out at several awards and the rumor mill has run wild, we can start taking a serious look at the latest Academy Awards odds.

The red carpet doesn’t roll out for the 2026 Oscars until March 15th, so we still have time to research and formulate some winning wagers.

Several Oscars betting markets stand out, but the big one forever remains Best Picture. BetMGM has Best Picture odds available to the public, with one clear favorite pulling in ahead of the rest. But based on what went down at the Golden Globes and other awards shows, is there a better option for entertainment bettors?

Let’s scan the latest Best Picture betting odds, discuss the top favorite, and identify some viable pivots. I’ll even tough on some longshot bets, some Oscars betting tips, and wrap things up with a final Best Picture prediction.

Current Best Picture Odds (2026)

| Best Picture Nominee | Odds to Win Best Picture |

|---|---|

One Battle After Another | -300 |

Sinners | +333 |

Hamnet | +1000 |

Marty Supreme | +2500 |

Sentimental Value | +5000 |

Bugonia | +6600 |

Frankenstein | +6600 |

The Secret Agent | +8000 |

Train Dreams | +8000 |

F1 | +10000 |

One Battle After Another comes in as the clear betting favorite to win Best Picture at the 2026 Academy Awards. The Leonardo DiCaprio vehicle is a riveting cat-and-mouse shakedown that starts in arguably contrived fashion, but sets up exceptional characters and takes you on a tense ride that keeps you strapped into your seat until the very end.

While it makes sense as the Best Picture favorite, there could be some wiggle room for an upset. It isn’t priced at -1000 or anything insane, after all, while it does have some weakness to its armor.

That puts top contender Sinners in play, especially when you consider that the Michael B. Jordan thriller earned an Oscars record 16 nominations.

‘SINNERS’ has broken history as the MOST-NOMINATED FILM OF ALL TIME at the Oscars with 16 nominations

See the full nominees list: https://t.co/IuSVQZPi7d pic.twitter.com/qUzPM49IQ0

— DiscussingFilm (@DiscussingFilm) January 22, 2026

Strength in numbers is certainly a thing, but none of that necessarily guarantees a Best Picture win.

Still, the Academy has spoken. They loved Sinners and if they enjoyed it enough to give it the most nominations for this year – nay, the most nominations of any movie of all-time – then you better believe it’s a threat.

In terms of Best Picture odds, nobody else comes close. This is probably One Battle After Another’s race to lose, and if it doesn’t win, Sinners is almost definitely the one to watch.

That said, at first glance, Hamnet and Marty Supreme do stand out as value bets that just might have legs. To get a better feel of the race to win the Best Picture award, let’s first dive into One Battle After Another’s case as a -300 favorite.

Why One Battle After Another is the Favorite

This was an exceptional movie from a tonal perspective, while the direction was fantastic and the acting was near-perfect. The only knock on this film was that the backstory was fairly unrealistic, while there are a few loose ends in the movie.

That said, we get a genre-blending action drama that takes you on a wild ride, while tugging at emotional strings and touching on relevant political commentary. It’s not your usual Best Picture contender, but that is also partially what makes it so good.

If you want to build a case for this movie, we need more than just numbers. Here is how it’s done at some key film festivals and other award shows:

- Critics’ Choice Award – Winner, Best Picture

- Chicago Film Critics Association Awards – Winner, Best Picture

- Dallas-Fort Worth Film Critics Association Awards – Winner, Best Picture

- Gotham Awards – Winner, Best Feature

- Los Angeles Film Critics Association Awards – Winner, Best Picture

- National Board of Review, USA – Winner, Best Film

- New York Film Critics Circle Awards – Winner, Best Film

- Golden Globes – Winner, Best Motion Picture (Musical or Comedy)

There’s more to add to the list, but these are the biggest ones. One Battle After Another has been a regular contender for top movie, and it has knocked it out of the park against elite competition routinely over the past year.

All roads lead to this movie being the rightful favorite to win at the 2026 Oscars, and the odds back that up.

It’s not just the regular critics at award shows, either. RottenTomatoes.com features consensus ratings, with the critics producing a 94% score and regular viewers generating an 85% rating.

Critics and moviegoers alike loved this movie, and it is pulling into the Oscars with positive online feedback and reasonable momentum after winning again at the Golden Globes.

Why It Might Not Win

If you’re looking for some key takeaways as far as going against the grain, keep in mind that a -300 price doesn’t mean a win is a lock. This is the obvious frontrunner, but we have seen Oscars upsets before, and more are sure to come.

More specifically, the fact that Sinners garnered 16 nominations and comes in with the second-best odds to win Best Picture is somewhat alarming. If there’s a red flag for this bet, that’s it.

The other thing is, this movie doesn’t fit the mold of your usual Oscar-winning movie. The occasional oddball does get the nod, but there’s no denying that not everyone agrees that One Battle After Another checks the usual boxes of a Best Picture winner.

Top Best Picture Contenders for 2026

- Sinners (+330)

- Hamnet (+1000)

- Marty Supreme (+2500)

If you’re looking for a realistic Best Picture upset this year, it almost definitely is coming from these three movies, with Sinners pulling in as the very best bet.

Here’s a quick-hitting breakdown for why each of these Best Picture nominees has a shot, and why they probably will fall short:

Sinners

Sinners has a firm public backing thanks to its commercial success, high ratings at movie critic sites, and the record 16 Oscar nominations it received.

Why It Can Win

- 16 nominations and huge

- Huge following + support

- Critical + commercial success

Why It Won’t

- No marquee wins at other award shows

- The horror genre doesn’t fare well at the Oscars

Hamnet

Hamnet is a distant third, but it also pulled in a stellar 11 Oscar nods and is directed by an Academy Award-winning director in Chloe Zhao. In terms of pedigree and production, it’s certainly a viable value bet.

Why It Can Win

- Guided by Oscar winning director

- Has 11 Oscar nominations

- Won best dramatic movie at the Golden Globes

Why It Won’t

- Lacking noteworthy buzz like top contenders

- Lacking many marquee wins in this category

Marty Supreme

Lastly, Marty Supreme is a compelling underdog story and is a loose biopic, which are two things the academy eats up. On top of that, it was well-received by critics and stars Oscar posterboy Timothee Chalamet, while the film has also received numerous nominations.

Why It Can Win

- Features an Oscar-winning lead actor

- Biopic-centric content aligns with Oscar winners

- Smaller nomination count than contenders

Why It Won’t

- Lacking marquee wins at other award shows

- Smaller nomination count than contenders

Each of these Best Picture contenders has a mild case to dethrone One Battle After Another as the top favorite. However, they also all have glaring weaknesses by comparison.

If you’re hunting for a contender worth betting on, Sinners is the only true standout. Historically, movies that led the way with the most total nominations have a very good chance to win Best Picture, and the buzz surrounding this movie is deafening.

Oscar’s Longshots with Serious Legs

- Bugonia (+6600)

- Frankenstein (+6600)

If you want Best Picture longshots that actually have a (slim) chance of winning, I’d start with Bugonia or Frankenstein. Both of these movies were helmed by brilliant directors, featuring massive star power that delivered exceptional acting performances, and were also beautifully shot.

On top of that, they were both critically and commercially well-received. They both have the framework needed to make a strong push, but their Best Picture odds leave a lot to be desired, making them poor bets to actually win.

But Oscars upsets do happen, and sometimes (albeit very rarely) a movie can come out of nowhere to shock the world. Here’s a quick case for both of these movies winning Best Picture this year:

Bugonia

For starters, Bugonia is quite the trip. You should be expecting that if you’re familiar with rising academy darling Yorgos Lanthimos, who probably should have won an Oscar for best director by now.

If you’re unfamiliar, buckle up, as Lanthimos is the king of tension-building. There are certainly points in Bugonia that are unrealistic or even corny, but the vast majority of it plays like a ticking time bomb toward impending doom – but not the kind you hope passes in a hurry.

This high-concept tale of two men seemingly trying to save the world from alien control is equal parts twisted and deeply emotional. Lanthimos succeeds in telling a powerful story here while engaging the audience in an epic dialogue duel between Emma Stone and Jesse Plemons.

The odds are long, but the story is captivating, well-directed, and perfectly acted.

Frankenstein

The situation is similar for Guillermo del Toro’s Frankenstein, which naturally fits like a glove into the Best Picture category. Del Toro himself broke the “horror can’t win” when The Shape of Water got him some Oscars hardware, and some would say he offers a more compelling narrative in this film.

Oscar Isaac and Jacob Elordi combine their efforts to carry a methodical and nuanced spin on the classic tale, one that is both brooding with darkness, but also secure in emotional depth.

The main knock on Frankenstein was that it lacked punch and was a bit slower-moving than some would have preferred. However, it is arguably the best rendition of the story in a live-action film to date, and there’s nothing bad to say about the acting performances, direction, or storytelling.

The bummer? If you weren’t floored by del Toro’s big heave, then you might come away thinking he dropped the ball. I’d disagree, but there is a very strong argument that it didn’t deliver in the face of some legit competition.

Ultimately, neither of these movies are great bets at this point. The 10 Best Picture nominees are locked in, and they have middle-of-the-road odds, at best.

Frankenstein definitely aligns more with what the academy looks for in an Oscar winner, but sometimes it takes something wacky to win the Oscars voters over. Bugonia was subjectively the more engaging and engrossing film (and the one I personally enjoyed more), but it admittedly doesn’t fit the type of movie that generally claims this award.

Looking back at the odds of Best Picture winners in the past, we haven’t seen a plus-money movie win since Parasite (+173) back in 2020. That’s only five years, of course, while Green Book (+210) was a surprise winner the year prior, and Moonlight (+430) blew everyone away back in 2017.

If you want something crazy like Bugonia or Frankenstein – assuming their prices stay where they are – you’ve got another thing coming. While worthy of consideration in my book (and certainly deserving Oscars nominees), their odds are a virtual death sentence.

Key Note: You can bet on slight underdogs like Sinners, but a Best Picture winner has never been beyond +1000. In fact, the biggest recorded underdog is still Braveheart (+600) from 1996.

A Best Picture upset could be in play, but it won’t be coming from Bugonia or Frankenstein, even though they are films you absolutely should watch.

How the Best Picture Odds Got Here: Dissecting Awards Season Market Movement

The path to winning Best Picture is always an interesting one. The process typically starts early in the summer, when Best Picture betting odds drop with sometimes 100 different candidates.

The early Best Picture favorite often doesn’t stand the test of time, but typically, your winner is at least somewhere within the movies with the top 20 odds. Naturally, betting on the Best Picture winner well ahead of time is preferred, but it’s tough to know which movies will generate the most buzz, and which ones will actually snag hardware at the big award shows.

In fact, this year’s Best Picture favorite was not among the top 10 movies in terms of odds initially. That has everything to do with it not officially being released to theaters until August, but it went on to gain major steam and eventually dominate from there.

Before that happened, however, films like Sentimental Value, Jay Kelly, Rental Family, Wicked For Good, and others cracked the top 10. Sentimental Value is still technically in play, but those other movies didn’t even get officially nominated.

Here’s what you need to keep in mind:

- Consider pouncing on early odds (lightly)

- Wait until after August for the second wave of bets

- Consider the final bet after the December 31st cut-off

- Note the award show’s success and online buzz

If you want maximum value, betting on who will win Best Picture when the odds first drop is suggested. The information is lean, and voters aren’t dead set on anything yet, though, so betting lightly is the way to go.

There is a second wave of films that tend to drop in July and August, which gives you a rough checkpoint to reassess the state of the race to win Best Picture. Some of the previous top contenders will stay strong, but you’ll notice others slowly begin to drop off.

Pay attention to smaller movie award shows and film festivals, and they can deliver nuggets of information, buzz, and actual winners that could contribute to your betting strategy.

Tip: Joker was never a big favorite to win until it started heating up after a win at the Venice Film Festival in 2019. It won the Golden Lion, however, and never looked back.

Huge and unexpected moments like that can flip the Best Picture race on its side. We saw something similar when One Battle After Another hit theaters in August, as it killed the hopes of several contenders and gave Sinners its first real, legitimate threat.

Naturally, tracking these big events are vital to your Best Picture betting success. Here are the big ones to note as the film award season heats up:

- Critics Choice Awards

- Screen Actors Guild Awards

- Golden Globes

- Producers Guild of America Awards

All of these can tip the hand of voters to a degree, but none of them have as high an alignment as the Producers Guild of America Awards.

Why? Because the voters are made up of like-minded producers who tend to align with what the academy likes. For the most part, the movie they back is the one that wins at the Oscars as well.

Don’t believe me? Their pick went on to win Best Picture in each of the last five years, and those picks have failed to align just 10 times since 1989.

There’s still time to process everything and finalize your bets, though, as the 2026 Producers Guild of America Awards don’t go down until February 28th.

Smart Best Picture Betting Angles

Now that you know who the top favorite to win Best Picture is, along with some viable contenders, here’s a quick checklist of Best Picture betting tips to keep in mind:

- Note the PGA Award Winner – While not a foolproof strategy, these picks almost always align. The only issue? You have to wait very deep into the process, and it can hurt your chances of securing premium odds.

- Place a Bet Early – Due to buzz and award show wins piecing together a fairly clear picture, it’s good to place eat Best Picture bets. Bet in waves, with your first bet when the original pricing drops, and then consider two more informed bets later in the year.

- Track Nomination Breadth – Movies that pull a lot of nominations carry more weight, are seen more, and get more buzz. The more traction a film is gaining, the better its chances of striking gold at the Oscars.

- Strong Narrative – A huge aspect to the voting process is narrative. Is there an iconic actor or director attached to a successful project? Perhaps the Academy can kill two birds with one stone by picking a worthy winner that also pays respect to a veteran talent.

- Follow Buzz & News – Social media is rife with speculation and rumors, but online buzz can build out new narratives, prop up contenders, and give you clues as to which underdogs may have a fighting chance.

When placing early bets on who will win Best Picture, I’d juggle wagers that either make too much sense to ignore versus films you’re passionate about that return incredible value.

It’s much easier to get behind a movie you personally loved, especially if you also believe it has the legs to go the distance. The bigger the shot early on, the easier it is to hedge that original bet, too.

At the same time, particularly as the process advances month after month, do your best to remove personal bias as you work your way into a fresh bet. Try to establish legit contenders compared to weak challengers, and keep in mind what the Academy tends to prefer in Best Picture candidates.

Who Will Win Best Picture at the 2026 Oscars?

One Battle After Another (-300)

If I am not removing any personal bias, One Battle After Another is the easy pick. It was an extremely tense movie with superb acting and solid storytelling. It has also gained an insane amount of momentum over the last few months.

When looking at the movie itself, the director, the acting, and the content, it does check most of the boxes of an Oscar winner. It also is not that far behind Sinners with 13 nominations.

Even if I remove my own perception of the movie, it enters as the clear favorite according to prediction markets, it has positive momentum, and it has cleaned up on the awards circuit.

The only real challenge is Sinners. It’s a worthy foe, as it could stage the upset based off of cinematic aesthetics, storytelling, direction, and cultural impact. There is absolutely a world where it wins, and nobody should be mad about it.

But the best movie between these two is One Battle After Another. And despite there probably being a sizable gap, you’re getting it at a bit of a discount at its current -300 odds.

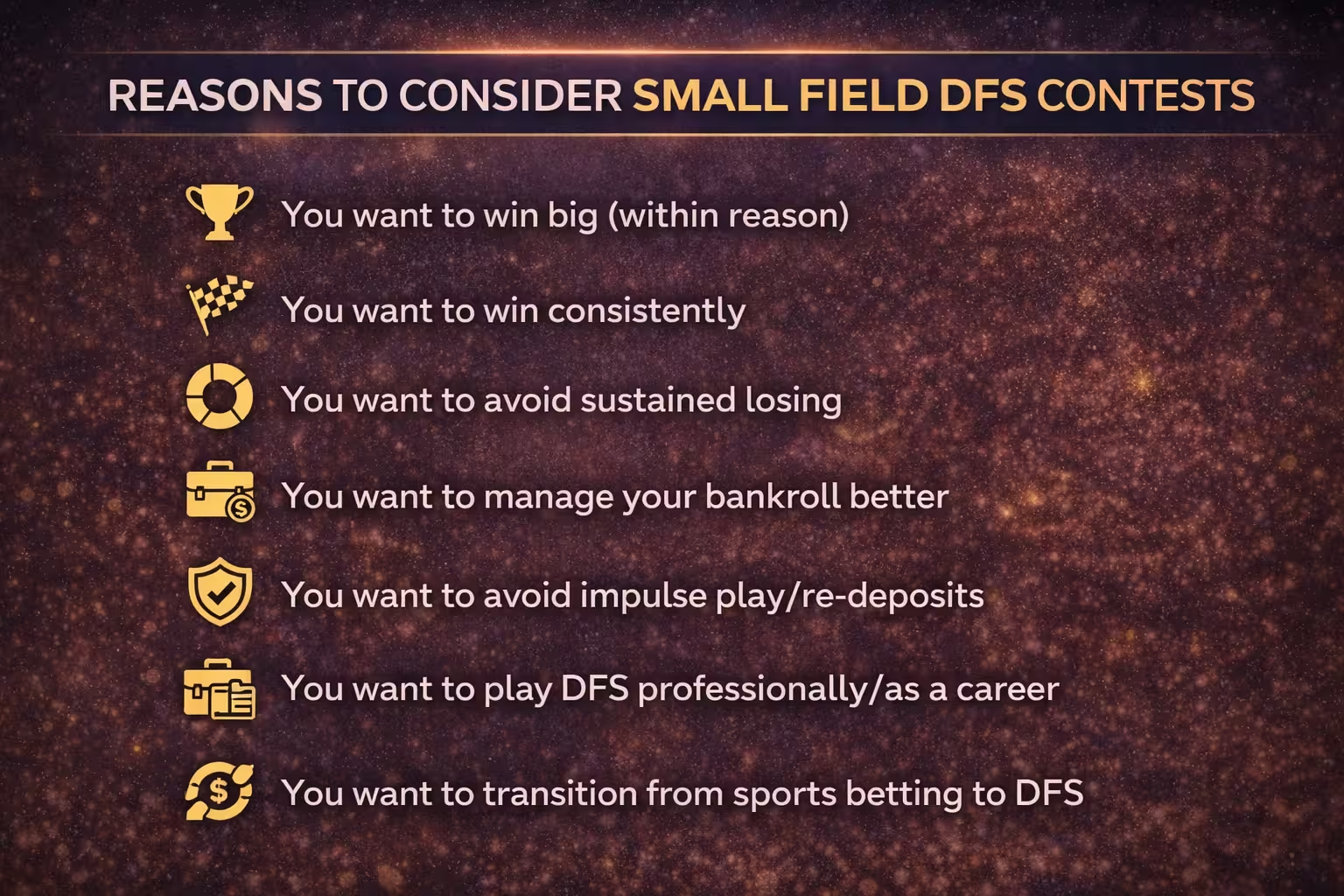

Why Small-Field DFS Contests Are Beating Large GPPs

If you’re not first, you’re last. Those are the famous and totally rational words of the iconic Ricky Bobby from Talladega Nights. The fact that I’m quoting Will Ferrell should probably tell you those might not be words to live by, though.

There’s no denying that nailing a “bink” or a “takedown” in daily fantasy sports is the dream. Everyone wants to win the NFL Milly Maker or finish first in some crazy tournament that nets them life-changing money.

The problem? It’s really hard to do. It’s also simply mathematically not very realistic. And the best daily fantasy sports (DFS) players have taken notice. You can still chase those extreme highs, but preventing the extreme lows and soaking up more sustainable wins has become a much more attractive endeavor – even if it works against the public norm.

With that, let’s dig deeper into why small-field DFS contests are winning the day, and why massive GPPs are increasingly left for the fish to fight over.

The DFS Myth That Refuses to Die

One of the biggest problems with daily fantasy sports is expectation and deliverability. New players, especially, can get drawn in by the obsession over huge wins.

In today’s social media-driven age, big wins and massive five-figure payouts are placed directly in front of you. Seasoned players still chasing that big win can get jealous and wonder when their time will come. New players will assume if they work hard enough and long enough, they’ll get that epic takedown, too.

Except it’s never a given, and the reality is that you really just see the high point. The crazy first-place finish and the big cash prize? That’s for everyone to see via screenshots on social media or in Discord communities.

Here are the two problems with this mentality:

- Struggles aren’t broadcast

- Sharp play vs. ROI

First, the road DFS players take to get to that elusive big score is often a long and winding one. If you put in enough time, research, and money, maybe – just maybe – your next big swing can net you a glorious win that you can share with the masses.

Truth be told, that could obviously happen. That reality is what makes DFS so great. But you only see the success, and unfortunately, you usually need to experience the brutal lows to fully understand them.

In addition, this chase for first place in a massive tournament – one where it’s your lineup against sometimes hundreds of thousands – skews how we look at lineup building from a strategic perspective.

To win in any tournament, you need to have a good lineup. You also need some leverage via low-owned or “contrarian” options. That combination won’t always lead to winning results, and nailing the perfect formula is different for each contest. The sheer idea of it can also be counterintuitive when trying to win.

Example: You need low-owned players that also go off and get you a lot of points. But to get those players, you’re rolling the dice on players who are usually overlooked by the field for a reason.

In other words, the very strategy that sharp players deploy could be precisely why your lineups are not contending – or worse, not even cashing.

Your plight to chase that big win is compounded by the very strategy required to land it; risky plays can lead to big swings in your favor, but more often than not they just lead you to a losing lineup a lot faster.

The Structural Problem with Large GPPs

Winning a big GPP (guaranteed prize pool) is extremely difficult. The number of lineups and different combinations you’re up against are massive. And even if you do piece together a lineup that’s close to contending, you still might run into trouble.

Here are two things that make big GPPs so difficult to master:

- Payout curve

- Lineup duplication

The first big issue is that most of the big GPP tournaments are insanely top-heavy as far as the payout is concerned. That’s how they can afford to issue crazy $100,000 or even $1,000,000 prizes to the first-place winner; less than the top 1% get the big money.

When looking at the low percentages and high lineup volume, you’re not just contending with the field – you’re literally working against every single lineup in the contest. This creates extra emphasis for both creating unique lineups that can separate from the pack and “maxing” a contest by hitting the entry limit.

Even those things aren’t always going to save you. If everyone can play 150 lineups, then all you’re doing is leveling the playing field against the other players that are max entering. You might feel like you’re gaining an edge, but in reality, you’re probably doing the bare minimum.

It gives you the maximum opportunities to try to give your unique grouping of lineups the best chance possible, but it, at the same time, guarantees nothing.

The other issue is lineup duping, which is certainly more prevalent from an exact definition perspective when dealing with Showdown slates, tiny two or three-game slates, or sports with finite player pools such as NASCAR and MMA.

In showdown contests and sports like NASCAR and MMA, true dupes (exact same lineups) are common and sometimes simply not very avoidable. In big GPPs for bigger sports like the NFL, MLB, and NBA, the “lineup duping” issue lies more within your build structure.

Most of the best plays for a given slate are ones that everyone knows about, and a good chunk of the field will simply “eat the chalk” and play them. That’s definitely something you’ll usually want to do, situation depending, but the more chalk you eat, the less unique your lineups will be.

This creates an obvious issue: for massive GPPs, you have to intentionally stray from some of the best plays on the slate just to ensure your lineup construction isn’t one that is being used in a majority of lineups across the entire contest.

Needless to say, the chase for perfection can still fall short. Even when a lineup is basically perfect, it may still fail to take down first place due to volume of lineups, payout curve, lineup duplication, or general variance not working in your favor.

Why Small-Field DFS Contests Change the Math

If you can ditch the dream of cashing in insane money (or embrace the reality of it not being very realistic) you can clean up in smaller DFS contests.

At least math suggests your odds are better. After all, when you’re looking at smaller GPPs or single-entry tournaments, you are inherently improving your odds due to a number of key factors:

- Flatter payouts that reward top 20% finishes

- Fewer entries/lineups to compete with

- Less of a need for high variance plays

- Skill carries more weight in your lineup’s result