How Event Contract Settlement Works (Step-by-Step Breakdown)

Event contracts feel deceptively simple. You buy Yes or No. The event happens. One side gets paid. End of story… right?

Not quite.

The real action in prediction markets doesn’t happen when you place the trade—it happens after the event ends. That’s where settlement comes in, and it’s the part most traders barely think about… until something goes wrong.

Who actually decides the outcome? What happens if early reports conflict? What if an event changes, gets delayed, or ends in a way nobody expected?

These aren’t edge cases. They’re the exact moments where weak markets break—and where strong ones prove they deserve your trust.

In prediction markets, settlement is the line between opinion and truth. Prices reflect belief, but settlement is where belief is tested against clearly defined rules and public sources of record. Get this part right, and markets function smoothly. Get it wrong, and confusion, disputes, and lost confidence follow quickly.

This guide breaks down exactly how event contract settlement works, step by step. You’ll see who controls the final call, how payouts are calculated, and why experienced traders obsess over settlement language before they ever look at price.

Once you understand settlement, you don’t just trade smarter—you trade with confidence.

Why Event Contract Settlement Matters More Than You Think

Most people think the hard part of prediction markets is picking the right side. It isn’t.

The real risk—and the real edge—lives in the settlement rules.

Pricing tells you what the market believes. Settlement determines what the market accepts as truth. If those two ever drift apart, everything else stops mattering. A perfectly priced contract can still turn into a bad trade if the settlement criteria are vague, poorly defined, or misunderstood.

This is why experienced traders care less about flashy markets and more about boring details like resolution sources, cutoff times, and edge-case language. Settlement is where trust is either reinforced or destroyed. One controversial outcome can permanently damage a market’s credibility, no matter how much volume it once had.

Unlike traditional sportsbooks—where grading decisions are made internally—event contracts rely on pre-written, public rules that define exactly how an outcome will be resolved. That transparency is a feature, not a technicality. It removes discretion, reduces disputes, and forces markets to align with verifiable reality instead of interpretation.

In short:

- Good pricing attracts traders

- Clear settlement keeps them coming back

If you understand how settlement works, you don’t just avoid mistakes—you spot weak markets early, pass on risky contracts, and trade with confidence when others hesitate.

What “Settlement” Means in Event Contracts

In prediction markets, settlement is the moment when uncertainty ends and the contract is finalized.

It’s the process by which an event contract is officially resolved, assigned a final value, and converted into cash. Until settlement occurs, prices can move, opinions can change, and traders can enter or exit positions. Once settlement happens, everything stops. The result is locked in.

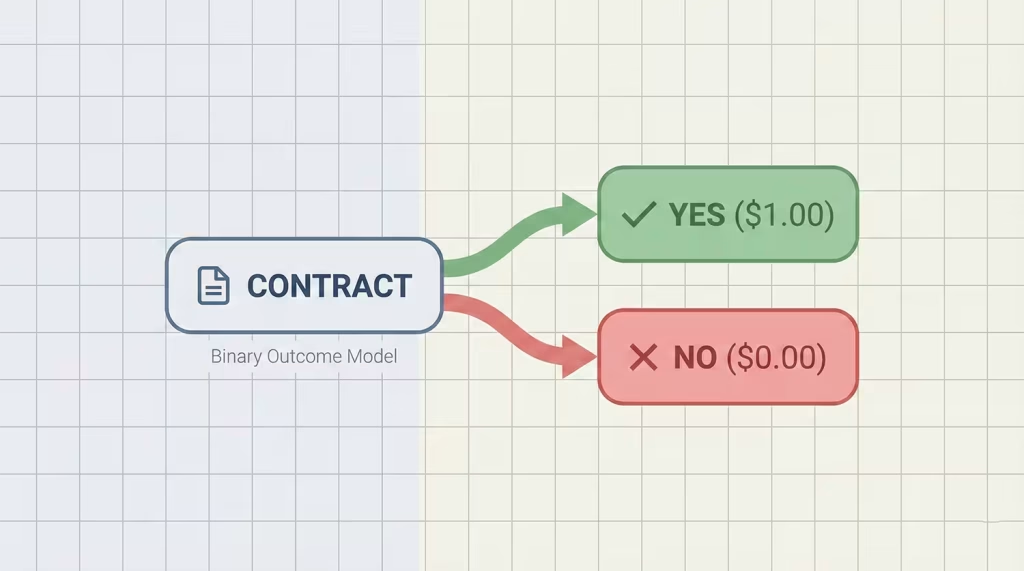

Most event contracts are binary, meaning they resolve to one of two outcomes:

- Yes or No

- Win or Lose

- Happens or Does Not Happen

There is no middle ground. A contract doesn’t “mostly win” or “almost lose.” At settlement, each contract is worth either $1.00 or $0.00, based entirely on whether the predefined conditions were met.

It’s important to separate settlement from other parts of the trading process:

- Pricing reflects what the market believes will happen

- Trading reflects how confident participants are in those beliefs

- Settlement reflects what actually happened, according to the rules

That distinction is what makes event contracts fundamentally different from opinion polls or speculative discussions. Prices can be wrong. Opinions can be loud. But settlement is governed by clear, written criteria tied to a specific source of truth.

Once you understand settlement, prediction markets stop feeling abstract. You’re no longer betting on vibes—you’re trading contracts that resolve based on defined, verifiable outcomes.

Who Decides the Outcome? (The Source of Truth)

In prediction markets, outcomes aren’t decided by popular opinion, platform discretion, or “what everyone agrees happened.”

They’re decided by the source of truth.

Every legitimate event contract clearly defines—before trading opens—the authority that will be used to determine the final outcome. This is one of the most important lines in any contract, yet it’s also one of the most overlooked by new traders.

The source of truth is the external, verifiable reference the platform relies on to settle the contract. Once the event concludes, the platform does not interpret the result—it checks the outcome against this predefined source and settles accordingly.

Common sources of truth include:

- Official sports leagues or governing bodies (final scores, results, rulings)

- Government or election authorities (certified election results)

- U.S. regulators like the Commodity Futures Trading Commission oversee how certain event contracts are structured and settled.

- Courts or regulatory agencies (legal decisions, approvals, or rejections)

- Public records or published data from named institutions

This matters because it removes subjectivity. The platform doesn’t get to “decide” who won after the fact, and traders don’t get to argue based on expectations or early reports. The rule is simple: what does the named authority officially declare?

Clear sources of truth protect everyone involved. Traders know exactly what will determine the outcome, platforms avoid disputes, and markets stay credible even when events are messy or controversial. If the source isn’t crystal clear, that’s not a minor oversight—it’s a warning sign.

The Event Resolution Timeline (From Close to Payout)

Once an event ends, trading doesn’t instantly turn into payouts. There’s a defined resolution process designed to make sure outcomes are accurate, verifiable, and final. Understanding this timeline helps set expectations—and prevents frustration when settlement isn’t immediate.

While the exact timing can vary by event type, the core steps are largely the same across prediction markets.

Here’s what typically happens after an event closes:

- Trading Is Halted

Once the event reaches a point where the outcome can no longer change, the market is closed to new trades. Prices freeze and positions are locked. - Verification Window Begins

The platform waits for confirmation from the predefined source of truth. This allows time for official results to be published, reviewed, or certified. - Outcome Is Confirmed

The platform checks the official result against the contract’s settlement rules. This step is mechanical, not interpretive—the outcome either meets the criteria or it doesn’t. - Contract Is Resolved

The market is formally settled. Winning contracts are marked as successful, losing contracts as unsuccessful. - Payouts Are Distributed

Funds are credited automatically based on final positions. No further changes can be made.

Some events—like final sports scores—can settle within minutes. Others, such as elections or legal decisions, may take hours or days. Delays aren’t a flaw; they’re often a sign the platform is prioritizing accuracy over speed.

Why Settlement Isn’t Always Instant

- Official results may take time to publish

- Certifications or confirmations may be required

- Edge cases or disputes need clarification

Patience here protects the integrity of the market.

Automatic vs. Manual Settlement

Not all event contracts settle the same way. While most are resolved automatically, some require a short review process to ensure the outcome matches the contract’s exact rules. Understanding the difference helps set expectations and explains why certain markets take longer to finalize.

Automatic Settlement: The Default for Clear Outcomes

Automatic settlement is used when the outcome is straightforward and easy to verify. Once the predefined source of truth publishes an official result, the platform’s system resolves the contract without human involvement.

This is common for:

- Final sports scores and match results

- Clearly defined statistical thresholds

- Events with a single, undisputed authority

Because the rules and data source are unambiguous, settlement can happen quickly—often within minutes of the event ending. For traders, this is the smoothest experience: fast resolution, instant payouts, and no uncertainty.

Manual Settlement: When Verification Matters

Manual settlement is used when an outcome requires additional confirmation. This doesn’t mean the platform is making a judgment call—it means the result needs to be checked carefully against the contract’s settlement criteria.

Manual settlement may occur when:

- Results are delayed, revised, or disputed

- Outcomes depend on technical definitions or qualifiers

- Multiple authorities or data sources are involved

- The event is political, legal, or regulatory in nature

In these cases, the platform verifies the final outcome using the predefined source of truth and documents the decision before settling the contract.

The key takeaway is simple: manual settlement prioritizes accuracy over speed. A short delay protects traders and ensures the market resolves exactly as promised.

When a platform explains why a market is manually settled, it’s usually a sign of transparency—not a red flag.

How Payouts Are Calculated After Settlement

Event contracts are designed to make payouts as transparent as possible. There’s no complicated grading, no juice math, and no interpretation once settlement occurs. Everything flows directly from the final outcome.

Most prediction markets use a $1 contract model, which means each contract resolves to a fixed value at settlement:

- Winning contracts settle at $1.00

- Losing contracts settle at $0.00

Your profit or loss is determined entirely by the price you paid to enter the contract.

Here’s how that plays out in practice:

- Buy a Yes contract at $0.58 → settles at $1.00 → $0.42 profit

- Buy a No contract at $0.58 → settles at $0.00 → $0.58 loss

- Buy at $0.85 → settle at $1.00 → smaller profit, lower risk

- Buy at $0.25 → settle at $1.00 → larger profit, higher risk

If you traded in and out of a position, settlement applies only to the contracts you hold at the moment the market closes. Earlier trades are already reflected in your balance.

Some platforms may deduct small fees or commissions, but these are typically disclosed upfront and applied automatically at settlement.

The simplicity is intentional. Once the outcome is confirmed, payouts are mechanical and final. There’s no debate, no reinterpretation, and no waiting on grading decisions—just a clean conversion from outcome to cash.

What Happens if an Event Is Canceled or Changes?

Not every event goes exactly as planned. Games get postponed, rules change midstream, and sometimes an outcome is never officially declared at all. Prediction markets account for this—but only according to the settlement rules written into the contract.

This is where many traders get caught off guard. What seems like common sense doesn’t always apply. Settlement follows the rules, not expectations.

Common Scenarios That Affect Settlement

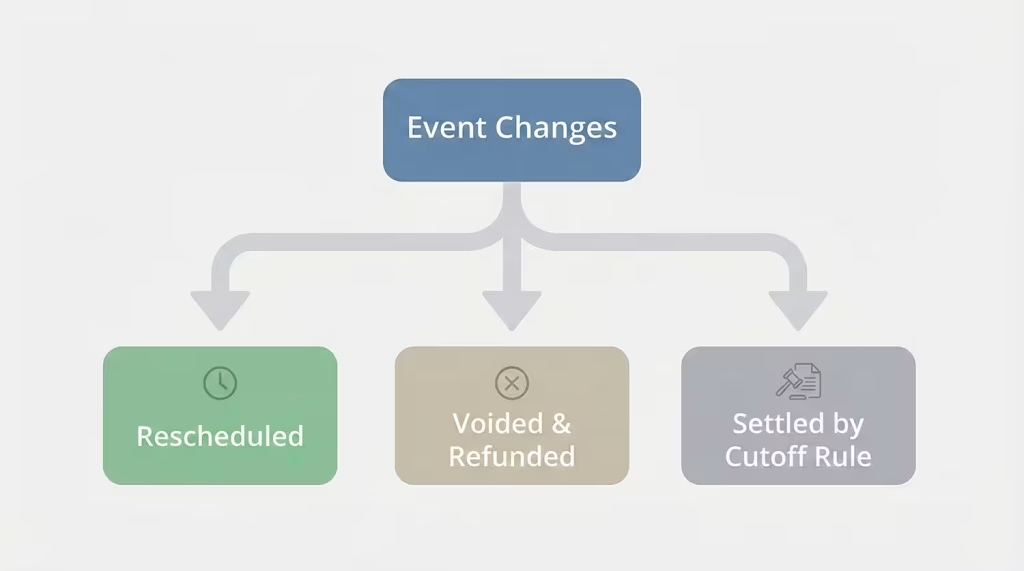

Event contracts usually address several types of disruptions upfront, including:

- Postponements or delays – The event may be pushed to a later date without changing the contract’s validity.

- Cancellations or no-contest rulings – If the event never occurs or is officially voided, the contract may be refunded.

- Rule or format changes – Changes in scoring, format, or structure may or may not impact settlement, depending on how the outcome is defined.

- No official outcome declared – If the predefined source of truth never issues a final result, the contract cannot settle normally.

How Contracts Typically Handle These Situations

Most platforms rely on one of three approaches when events change:

- Void and refund – All open positions are canceled and funds are returned.

- Reschedule and settle later – The contract remains active until the event is completed or a cutoff date is reached.

- Apply a predefined cutoff or fallback rule – If no outcome is declared by a specific date, the contract resolves according to the written criteria.

The key point: there is no improvisation. The platform does not “do what seems fair” after the fact—it applies the rule that was published before trading began.

Why This Matters for Traders

Sharp traders always check:

- How cancellations are handled

- Whether rescheduling affects settlement

- If a final outcome must be officially declared

Understanding these details protects you from surprises and helps you avoid markets where uncertainty isn’t worth the risk.

When events change, settlement clarity becomes the difference between a professional-grade market and a frustrating one.

Disputes, Appeals, and Edge Cases

Most event contracts settle cleanly. When settlement rules are clear and the source of truth is well defined, there’s usually nothing to argue about.

But edge cases do happen.

When they do, prediction markets rely on process, not opinions. Disputes and appeals are handled by applying the written settlement rules exactly as published before the event began.

When Disputes Typically Arise

Disputes aren’t about who someone thought should win—they’re about how the rules apply in unusual situations.

Common triggers include:

- Conflicting early reports from different sources

- Delayed or revised official results

- Ambiguous language in the contract’s resolution criteria

- Events with technical qualifiers or deadlines

- Rare situations where authorities issue unclear or partial rulings

In almost every case, the question isn’t what happened—it’s which version of the outcome counts under the contract’s rules.

How Platforms Handle Appeals

Reputable platforms follow a structured review process:

- The predefined source of truth is re-checked

- The contract’s settlement language is applied literally

- Public documentation is reviewed and archived

- A final settlement explanation is published when needed

Importantly, platforms do not change settlement rules after the fact. Appeals are evaluated against the same criteria every trader agreed to when entering the market.

Why Clear Rules Prevent Most Problems

The vast majority of disputes stem from unclear settlement language, not bad actors. That’s why experienced traders gravitate toward markets with:

- Narrow, well-defined outcomes

- Single, authoritative sources

- Explicit edge-case handling

When disputes are rare and transparently resolved, they actually strengthen trust. They show that the market doesn’t rely on discretion—it relies on rules.

If a platform can’t clearly explain why a contract settled the way it did, that’s not an edge case. That’s a warning.

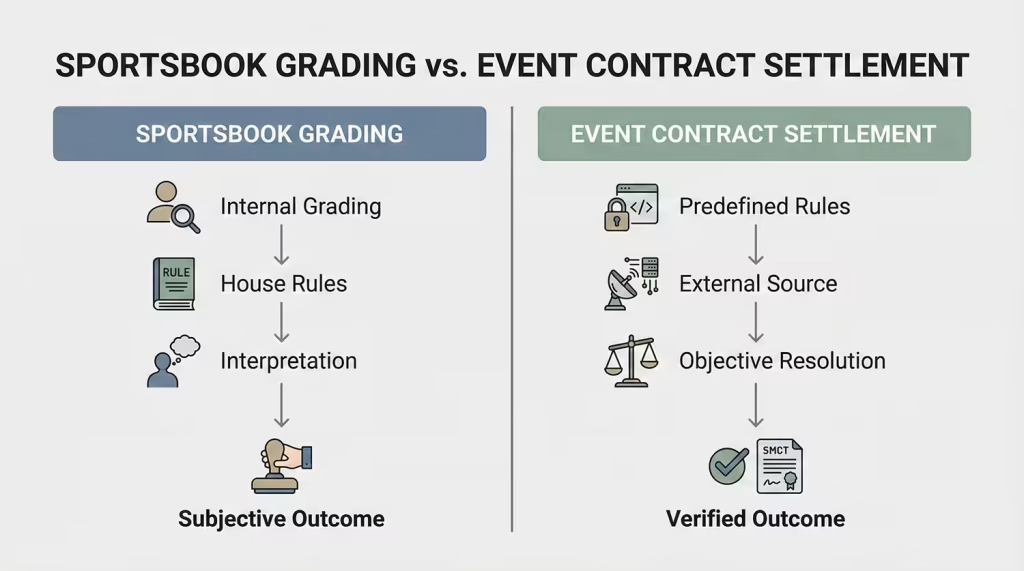

How Settlement Differs From Sportsbook Grading

At a glance, event contract settlement and sportsbook grading may seem similar. Both determine whether a position wins or loses after an event ends.

In practice, they operate very differently.

Sportsbooks and prediction markets answer two different questions:

- Sportsbooks ask: How do we grade this bet according to our house rules?

- Prediction markets ask: Did the event meet the predefined outcome criteria?

That difference changes everything.

Key Differences Between Settlement and Sportsbook Grading

Here’s where the contrast becomes clear:

- Who decides the outcome

- Sportsbooks: The book grades bets internally using its own rules

- Event contracts: Outcomes are determined by an external, predefined source of truth

- Rule flexibility

- Sportsbooks: House rules may include interpretation or discretionary clauses

- Event contracts: Settlement rules are fixed and published before trading begins

- Handling of edge cases

- Sportsbooks: May apply house judgment to unusual situations

- Event contracts: Apply written resolution criteria exactly as stated

- Transparency

- Sportsbooks: Grading logic is often buried in terms and conditions

- Event contracts: Settlement criteria are visible and tied to public records

- Finality

- Sportsbooks: Grading decisions can sometimes be adjusted

- Event contracts: Settlement is final once the outcome is confirmed

Why This Matters to Traders

For casual bettors, these differences may seem minor. For sharp bettors, they’re critical.

Prediction markets reduce uncertainty by removing discretionary grading. You’re not betting on how a house interprets a rule—you’re trading on whether a clearly defined condition is met.

That’s why many experienced bettors trust event contract settlement more than sportsbook grading, especially for non-standard events. When the rules are clear and the source of truth is public, outcomes feel less arbitrary—and confidence in the market grows.

Understanding this distinction helps explain why prediction markets aren’t just a new betting format—they’re a different system entirely.

Common Settlement Mistakes New Traders Make

Most settlement issues aren’t caused by bad luck—they’re caused by assumptions.

New traders often focus on what they think will happen instead of how the contract actually settles. That gap is where confusion, frustration, and avoidable losses show up.

Here are the most common mistakes:

- Not reading the resolution source

Traders assume the outcome will be obvious, then realize too late that settlement depends on a specific authority or publication. - Confusing early reports with final results

Initial news, projections, or unofficial announcements don’t count unless the contract explicitly says they do. - Ignoring cutoff times and deadlines

Some contracts require outcomes by a certain date or time. Missing that detail can change settlement entirely. - Assuming “common sense” applies

Settlement follows written rules, not expectations. What feels like a win may not qualify under the contract’s criteria. - Overlooking edge-case language

Clauses covering postponements, cancellations, or rule changes are easy to skip—and often the most important.

The fix is simple but powerful: treat settlement rules as part of the trade. Before entering any position, know who decides the outcome, how it’s verified, and what happens if the event doesn’t go exactly as planned.

Once you stop guessing and start reading, settlement stops being a risk—and becomes an advantage.

Why Sharp Bettors Obsess Over Settlement Rules

Sharp bettors don’t just ask “Is this priced well?” They ask “Can this settle cleanly?”

To professionals, settlement rules aren’t fine print—they’re the foundation of the trade. A market with unclear resolution criteria can turn a correct prediction into a losing position, or trap capital in a long, uncertain settlement window.

Before committing money, experienced traders evaluate settlement the same way they evaluate risk.

They look for:

- Clear, narrow outcome definitions with no room for interpretation

- A single, authoritative source of truth rather than multiple overlapping references

- Explicit handling of edge cases, including delays, cancellations, or rule changes

- Defined timelines so capital isn’t tied up indefinitely

- Consistency with how similar events have settled in the past

Sharp bettors also understand something most new traders don’t: settlement quality affects market behavior. Clear rules attract more volume, reduce disputes, and tighten prices. Vague rules scare away professionals and leave markets thin and inefficient.

That’s why pros sometimes pass on otherwise attractive prices. If the settlement language introduces unnecessary uncertainty, it’s not an edge—it’s a liability.

In prediction markets, confidence doesn’t come from being right. It comes from knowing exactly how “right” gets paid.

Final Takeaway: Settlement Is the Backbone of Prediction Markets

Event contracts don’t succeed because they’re new or interesting. They succeed because—when done right—they’re precise.

Settlement is where prediction markets either earn long-term trust or quietly lose it. Prices can be wrong. Opinions can shift. But settlement is final. It’s the mechanism that turns probability into reality and belief into cash.

Once you understand how settlement works, prediction markets stop feeling risky and start feeling logical. You’re no longer guessing how a platform might grade an outcome or worrying about house interpretation. You’re trading contracts that resolve according to clearly defined rules and publicly verifiable sources of truth.

That’s why experienced traders spend more time reading settlement language than watching price charts. They know that clean rules create fair markets, attract liquidity, and eliminate unnecessary surprises. When settlement is clear, confidence follows naturally.

Before entering any event contract, ask three simple questions:

- Who decides the outcome?

- How is it verified?

- What happens if the event changes?

If those answers are clear, the trade deserves consideration. If they aren’t, the price doesn’t matter. In prediction markets, settlement isn’t the fine print—it’s the whole point.