Kalshi vs. Polymarket: The Prediction Market Showdown That Could Reshape Betting in 2026

Sports betting isn’t being replaced — it’s being quietly outflanked.

While sportsbooks fight over promos and parlay boosts, a different kind of market has been exploding in the background. One where you don’t bet against the house. You trade outcomes instead. Prices move in real time. And information matters more than hype.

At the center of that shift are two names you’ve probably seen all over X and Reddit lately: Kalshi and Polymarket.

On the surface, they look similar. Both let users speculate on real-world events — from elections and interest rates to playoff races and season totals. But under the hood, they couldn’t be more different. Kalshi is regulated, fiat-based, and built to play inside the U.S. system. Polymarket is crypto-native, global, and optimized for speed and low fees.

This isn’t just a platform comparison. It’s a clash of philosophies.

In 2026, prediction markets could reshape how people bet on sports, politics, and everything in between. The question isn’t whether they’ll matter — it’s which model wins.

Let’s break it down.

TL;DR: Kalshi vs Polymarket

Kalshi and Polymarket are prediction market platforms that let users trade on real-world outcomes rather than place traditional sports bets. Kalshi operates as a CFTC-regulated exchange with fiat funding and U.S. access, while Polymarket is crypto-native, uses USDC, and emphasizes low fees and fast-moving markets.

Kalshi prioritizes regulatory compliance, structured sports-style markets, and clarity around settlement. Polymarket prioritizes speed, pricing efficiency, and niche or emerging events. Legal uncertainty, regulatory enforcement, and market structure will largely determine which model scales fastest by 2026. Many bettors currently use both platforms for different use cases rather than choosing one exclusively.

The Contenders: Two Platforms, Two Philosophies

At first glance, Kalshi and Polymarket look like they’re playing the same game. Binary outcomes. Yes-or-no questions. Markets that settle on real-world events. But spend five minutes on each platform and the truth becomes obvious: these two aren’t competitors by accident — they’re built on opposing beliefs about what betting should be.

This is regulated finance versus crypto-native chaos. And neither side plans on blinking.

Kalshi: The Regulated Market Maker

Kalshi positions itself less like a sportsbook and more like a financial exchange that happens to trade on real-world events. It’s a CFTC-regulated Designated Contract Market, meaning every contract, rule, and settlement process runs through federal oversight.

For users, that comes with trade-offs.

You fund your account with fiat. You complete full KYC. And markets resolve based on official, pre-defined sources — not community votes or oracles. The upside? Clarity, consistency, and legal protection. The downside? Fees, friction, and a distinctly “Wall Street” feel.

Kalshi’s big swing came when it leaned hard into sports-style markets. Point spreads, season-long outcomes, and playoff scenarios are all framed as event contracts rather than bets. That move unlocked massive volume and pulled in a wave of traditional sports bettors who wanted something new — but not too new.

Kalshi’s core strengths:

- Nationwide-first regulatory approach

- Deep liquidity in major markets

- Clear settlement rules and timelines

- Familiar UX for traditional bettors

Kalshi isn’t trying to move fast and break things. It’s trying to replace sportsbooks by outlasting them.

Polymarket: The Crypto-Native Challenger

Polymarket comes from the opposite direction.

Built on blockchain rails and settled in USDC, Polymarket is unapologetically crypto-first. Markets are peer-to-peer. Fees are minimal. Wallets replace bank accounts. And pricing often reacts faster to news than anywhere else online.

Historically, Polymarket thrived on politics, crypto events, and niche questions sportsbooks wouldn’t touch. Its user base skewed global, highly online, and aggressively price-sensitive. Even now, that DNA hasn’t changed.

What has changed is Polymarket’s posture toward regulation. After years operating offshore, it’s now pursuing a compliant U.S. path — without abandoning the low-cost, high-speed model that made it popular in the first place.

Polymarket’s core strengths:

- Near-zero trading fees

- On-chain transparency

- Rapid market creation

- Strong pricing efficiency in niche events

Polymarket isn’t trying to replace sportsbooks. It’s trying to out-evolve them.

Two Philosophies, Side by Side

| Category | Kalshi | Polymarket |

|---|---|---|

Regulatory Model | Fully CFTC-regulated | Crypto-native, compliance-focused |

Funding | Fiat (ACH, wire) | USDC via wallet |

Fees | Tiered (higher for small trades) | Extremely low |

Market Style | Structured, institutional | Flexible, fast-moving |

Ideal User | U.S. sports bettors, trad-fi users | Crypto-savvy traders, global users |

The takeaway is simple: Kalshi optimizes for trust. Polymarket optimizes for speed. Which one wins won’t depend on technology alone — it’ll depend on which philosophy bettors decide they believe in more.

Markets & Mechanics: How Betting Actually Feels on Each Platform

On paper, Kalshi and Polymarket both let you “bet” on outcomes. In practice, they feel like two entirely different experiences, even when the question on the screen is identical.

This is where most comparisons miss the point. The real difference isn’t regulation or crypto rails — it’s how markets behave once real money starts moving.

Market Coverage: Where Each Platform Shines

Kalshi’s edge is structure.

Its markets are designed to feel familiar to sports bettors: clear timeframes, standardized contracts, and predictable settlement rules. Season-long props, playoff odds, and macro sports outcomes dominate activity. You’re rarely guessing how a market resolves — the rules are spelled out before the first dollar trades.

Polymarket thrives in the gray areas.

It excels at questions that are fast, niche, or weird enough that sportsbooks won’t touch them. Politics, crypto regulation, celebrity news, tech milestones — if it’s trending on X, Polymarket probably has a market live within hours.

In short:

- Kalshi = polished, repeatable, mainstream markets

- Polymarket = reactive, experimental, long-tail markets

That distinction matters more than most users realize.

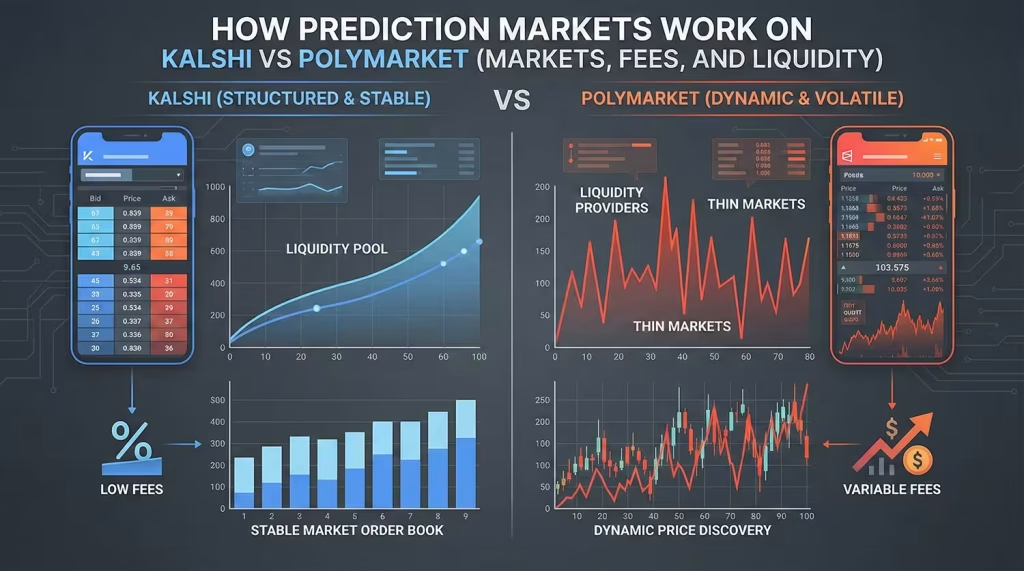

Liquidity, Pricing, and Why Volume Can Be Misleading

Liquidity is where the platforms feel most different.

Kalshi’s largest markets tend to be deep and orderly. Spreads are tighter in high-profile events, and price movement feels deliberate rather than chaotic. For sports bettors used to sharp books, this structure feels reassuring — even boring, in a good way.

Polymarket’s liquidity is more volatile. Some markets are extremely efficient, especially around elections and crypto events. Others are thin, jumpy, and prone to sharp price swings after a single large trade.

That volatility cuts both ways. It creates opportunity, but it also punishes hesitation.

Here’s the part casual users often miss: big volume doesn’t always mean good liquidity. A market can trade millions in notional value and still punish poor timing.

Fees, Speed, and Accessibility

This is where preferences really split.

Kalshi charges transparent, tiered fees that are easy to understand — but they can sting on smaller trades. The trade-off is convenience. You deposit fiat, place trades instantly, and never think about gas fees or wallets.

Polymarket’s fees are almost invisible by comparison. Trades cost next to nothing, and execution feels fast. But that efficiency comes with friction elsewhere: wallet setup, USDC management, and an onboarding curve that can feel steep to non-crypto users.

What users consistently report:

- Kalshi feels easier to start

- Polymarket feels cheaper to scale

- Kalshi favors casual volume

- Polymarket favors active trading

Trust, Transparency, and Market Resolution

Trust is the quiet deciding factor.

Kalshi resolves markets using predefined, official sources. There’s little ambiguity, and disputes are rare. Users trust the outcome even when they don’t like it.

Polymarket leans on oracles and on-chain verification. The upside is transparency — anyone can see trades and balances. The downside is complexity. Resolution disputes can happen, and when they do, newer users often feel lost.

Neither model is inherently better. They simply reward different temperaments.

The “Feel” Test

If you strip away branding, here’s what it comes down to:

- Kalshi feels like trading a regulated financial instrument

- Polymarket feels like speculating inside a live information market

One prioritizes predictability. The other prioritizes speed.

And that difference — more than fees, regulation, or hype — is what determines where bettors ultimately stay.

Regulation & Legal Reality: The Risk Most Bettors Ignore

Most bettors obsess over odds, timing, and fees. Very few stop to ask the uncomfortable question that actually matters long term:

What happens if the rules change mid-game?

That’s the shadow hanging over both Kalshi and Polymarket — and it’s where this rivalry gets real.

Kalshi’s Regulatory Tightrope

Kalshi’s biggest selling point is also its biggest exposure.

As a CFTC-regulated Designated Contract Market, Kalshi operates under federal oversight — a massive advantage compared to offshore sportsbooks or gray-market platforms. In theory, that status allows Kalshi to offer event-based contracts nationwide, even when states push back.

In practice, it’s messier.

Several states and tribal entities argue that Kalshi’s sports-style contracts cross the line into traditional sports betting — an area states believe they control. Lawsuits, cease-and-desist orders, and jurisdictional challenges have followed. None of them have shut Kalshi down outright, but they introduce uncertainty that bettors can’t ignore.

The key risk isn’t that Kalshi disappears overnight. It’s fragmentation.

If courts side with states, certain markets could become restricted or unavailable in key regions. Liquidity would suffer. Market depth could thin. And users in affected states might find themselves suddenly locked out of markets they were trading days earlier.

Kalshi is betting that federal authority ultimately wins. If it does, the platform’s position strengthens dramatically. If it doesn’t, growth slows — fast.

Polymarket’s Compliance Comeback

Polymarket’s legal story is different — and arguably more fragile.

After prior regulatory action forced it to step back from the U.S. market, Polymarket has spent the last year repositioning itself. The goal is clear: pursue a compliant path without sacrificing the speed and cost advantages that made it popular in the first place.

That’s easier said than done.

Crypto-native platforms live under constant regulatory scrutiny, even when they’re trying to play by the rules. Wallet-based access, global users, and decentralized infrastructure make enforcement complicated — which cuts both ways. Flexibility helps growth, but it also invites uncertainty.

For bettors, the risk isn’t prosecution or penalties. It’s availability.

Markets can change. Access rules can tighten. Features that work today may look different six months from now as regulators weigh in. Polymarket users have learned to expect that volatility — but new users often underestimate it.

The Bigger Fight: Who Actually Controls Betting?

Zoom out, and this rivalry isn’t just about two companies. It’s about who gets to define betting in the next decade.

- States want tax revenue and control

- Federal regulators want uniform oversight

- Platforms want scale and flexibility

- Bettors want access and efficiency

Those goals don’t naturally align.

Prediction markets sit right in the middle — too financial to be sportsbooks, too betting-adjacent to ignore. How that tension resolves will shape which platforms thrive and which stall.

For bettors, the takeaway is simple: regulatory risk is real risk. Ignore it, and you’re betting blind — no matter how good the odds look.

How Bettors Use Kalshi and Polymarket in Practice (User Behavior & Trends)

For all the noise around regulation, fees, and philosophy, the clearest signal comes from one place: where bettors are actually putting their money.

And the behavior tells a story that’s far more nuanced than “Kalshi versus Polymarket.”

The Two-Account Reality

One of the most common patterns emerging across X, Reddit, and Discord isn’t loyalty — it’s hedging.

A growing number of bettors maintain accounts on both platforms, using each for what it does best. Kalshi becomes the home for structured, higher-confidence positions tied to sports seasons or major macro events. Polymarket becomes the sandbox for fast-moving narratives, niche outcomes, and early information plays.

This isn’t indecision. It’s optimization.

Bettors aren’t choosing sides — they’re choosing tools.

Social Sentiment: Where the Crowd Is Leaning

Scroll through prediction market threads and a few themes keep popping up:

- Kalshi users praise stability, clarity, and ease of use

- Polymarket users emphasize speed, pricing efficiency, and flexibility

- New users consistently underestimate the learning curve on Polymarket

- Experienced traders complain more about fees than onboarding

Interestingly, trust rarely dominates the conversation anymore. Most users assume both platforms will resolve markets fairly. The real debates center on cost, access, and opportunity.

Volume Isn’t the Whole Story

Raw volume numbers get thrown around constantly, but they’re often misleading.

Kalshi’s volume tends to cluster around a smaller number of large, highly liquid markets. That creates smoother pricing and fewer surprises — ideal for bettors who value consistency.

Polymarket’s volume spreads across hundreds of smaller markets. Some explode overnight. Others sit dormant until a news catalyst hits. That fragmentation creates sharper mispricing — and sharper losses for anyone late to the trade.

What experienced bettors watch instead of volume:

- Bid–ask spread behavior

- Speed of price reaction to breaking news

- Depth at key price levels

- Resolution clarity

Those metrics reveal more about opportunity than headline numbers ever will.

The Quiet Trend Most People Miss

Here’s the shift flying under the radar: sports bettors are learning to think like traders.

They’re entering positions earlier. Exiting before resolution. Watching narratives instead of lines. Prediction markets reward that mindset — and punish anyone who treats them like a traditional sportsbook.

That behavioral change, more than any platform feature, explains why prediction markets keep growing.

And it’s why this fight matters.

Future of Prediction Markets: 3 Scenarios for Kalshi and Polymarket

Trying to crown a single winner right now misses the point. Prediction markets are still early, still fluid, and still shaped by forces far bigger than any one platform. What matters is how this ecosystem evolves — and there are three realistic paths forward.

Scenario 1: Regulated Dominance

In this future, federal authority holds.

Courts side with nationwide oversight, state challenges lose momentum, and regulated prediction markets gain a green light to scale. Kalshi becomes the default on-ramp for U.S. bettors looking for something sharper than a sportsbook but safer than offshore options.

Sports-style markets expand. Liquidity deepens. Institutions step in.

The result? Prediction markets start to look less like an experiment and more like a new asset class.

Polymarket survives — but largely offshore or focused on niche, non-sports events.

Scenario 2: The Crypto Surge

This version plays out very differently.

Fee pressure intensifies. Speed matters more than compliance optics. Crypto-native platforms innovate faster than regulators can respond. Polymarket’s low-cost, high-efficiency model pulls in active traders at scale.

As more bettors prioritize execution and pricing over structure, the center of gravity shifts. Regulated platforms struggle to compete on cost. Liquidity fragments — but opportunity explodes.

Kalshi remains relevant, but no longer dominant. The edge belongs to those who move first, not those who move safely.

Scenario 3: The Hybrid Era (Most Likely)

This is the outcome smart money quietly expects.

Regulation evolves. Platforms adapt. Lines blur.

Prediction markets combine regulated access with blockchain efficiency. Sportsbooks borrow market mechanics. Crypto platforms adopt clearer compliance frameworks. The distinction between “betting” and “trading” fades.

In this world, Kalshi and Polymarket don’t eliminate each other — they force convergence.

For bettors, that’s the best outcome. More access. Better pricing. Fewer artificial limits.

And more ways to win.

Practical Playbook: How to Use These Platforms Right Now

If you’re waiting for a clear winner before getting involved, you’re already late. The smarter move is understanding how each platform fits into your betting style today, not where headlines say the industry is headed.

Here’s how experienced bettors are actually approaching it.

For U.S.-Based Sports Bettors

Kalshi is the cleaner entry point.

If you’re used to traditional sportsbooks, Kalshi’s structure will feel familiar — just sharper. Markets are clearly defined, settlement rules are transparent, and liquidity is strongest on mainstream sports outcomes and season-long events.

Use Kalshi when:

- You want regulated, U.S.-accessible markets

- You’re betting longer-term outcomes, not rapid news swings

- You value clarity over chasing every pricing edge

Think of it as sports betting with a trader’s twist.

For Crypto-Savvy and Active Traders

Polymarket shines when speed matters.

If you’re comfortable with wallets, on-chain settlements, and rapid price movement, Polymarket offers flexibility you won’t find elsewhere. Early entries and fast exits are where its edge shows up.

Use Polymarket when:

- You’re reacting to breaking news or narratives

- Fees matter more than convenience

- You want exposure to niche or emerging events

This is less about picking winners and more about timing information.

One Rule Most Profitable Users Follow

They don’t treat prediction markets like sportsbooks.

Instead, they:

- Enter positions earlier

- Exit before resolution when value disappears

- Watch sentiment shifts as closely as prices

Prediction markets reward discipline and punish impulse. Used correctly, both platforms can coexist in your playbook — each doing what it does best.

Up next: where all of this leaves betting as we know it.

Conclusion: This Isn’t a Winner-Take-All Fight

It’s tempting to frame Kalshi vs. Polymarket like a championship bout — one winner, one loser, final bell. But that mindset misses what’s really happening.

Prediction markets aren’t replacing sportsbooks. They’re expanding the definition of what betting can be.

Kalshi represents structure, legitimacy, and a clear path for prediction markets to exist inside the U.S. financial system. Polymarket represents speed, efficiency, and the power of information-driven pricing in real time. Each solves a different problem — and each attracts a different kind of bettor.

The real shift isn’t about which logo wins in 2026. It’s about behavior. Bettors are thinking earlier. Acting faster. Trading narratives instead of chasing lines. That change doesn’t reverse, no matter how regulation shakes out.

The most likely future isn’t domination — it’s convergence. Regulated platforms adopt better mechanics. Crypto platforms move toward clearer rules. And bettors gain more tools, not fewer.

So the smart play isn’t picking sides. It’s staying adaptable.

Because the next evolution of betting isn’t coming.

It’s already here.

Alyssa contributes sportsbook/online casino reviews, but she also stays on top of any industry news, precisely that of the sports betting market. She’s been an avid sports bettor for many years and has experienced success in growing her bankroll by striking when the iron was hot. In particular, she loves betting on football and basketball at the professional and college levels.