Betting Odds vs. Implied Volatility: What Sports Bettors Can Learn From the Options Market

Sports bettors talk about odds like they’re predictions. Traders talk about volatility like it’s oxygen.

They’re actually talking about the same thing—risk—just in different languages.

Sportsbooks don’t set lines because they “know” who’s going to win. They set lines because they’re pricing uncertainty, protecting exposure, and anticipating how money will flow once information—or emotion—hits the market. That’s the same job performed by market makers on Wall Street. Different asset. Same mechanics.

This is where most bettors go wrong. They look at odds and see confidence. The market sees fear. They chase games that feel obvious, exciting, or chaotic—without realizing they’re often paying a premium for that uncertainty. When lines move fast, totals inflate, or juice quietly rises, volatility is already being priced in.

That concept has a name in the options world: implied volatility.

You don’t need to trade options to benefit from understanding it. You just need to recognize that sportsbooks already think in volatility terms—even if bettors don’t. Once you start viewing betting odds as prices of risk rather than predictions of outcomes, you stop overpaying for chaos.

And that’s where real edge begins.

What Betting Odds Actually Represent (Beyond Win Probability)

Most bettors learn odds as a shortcut to probability.

That’s not wrong—but it’s incomplete.

Sports betting odds are not predictions of what will happen. They’re prices set by a risk manager whose job is to control exposure, anticipate behavior, and protect the book—not to be right about the final score.

Yes, odds imply probability. But that probability is filtered through multiple layers before it ever reaches the bettor. Sportsbooks adjust lines based on how they expect money to come in, not just how likely an outcome is in a vacuum. That’s why two evenly matched teams can still carry very different prices depending on public perception, timing, and market conditions.

At a high level, betting odds reflect a combination of:

- Implied probability – the baseline likelihood suggested by the line

- Vig (house margin) – the cost of accessing the market

- Expected betting behavior – where public money is likely to land

- Risk exposure – how much liability the book is willing to hold

- Market sentiment – narratives, hype, and recent results influencing demand

This is why you’ll often see two -110 sides that don’t represent a true 50/50 outcome. The book isn’t saying both teams are equal—it’s saying this is the price that keeps their risk balanced while collecting a margin.

If you want a foundational breakdown of how odds are displayed and calculated across moneylines, spreads, and totals, our Understanding Betting Odds & Lines guide walks through the mechanics in detail.

The key takeaway here is simple but critical: odds don’t tell you what will happen. They tell you what the market is charging for uncertainty. And once you understand that, you stop reading lines as opinions—and start reading them as prices.

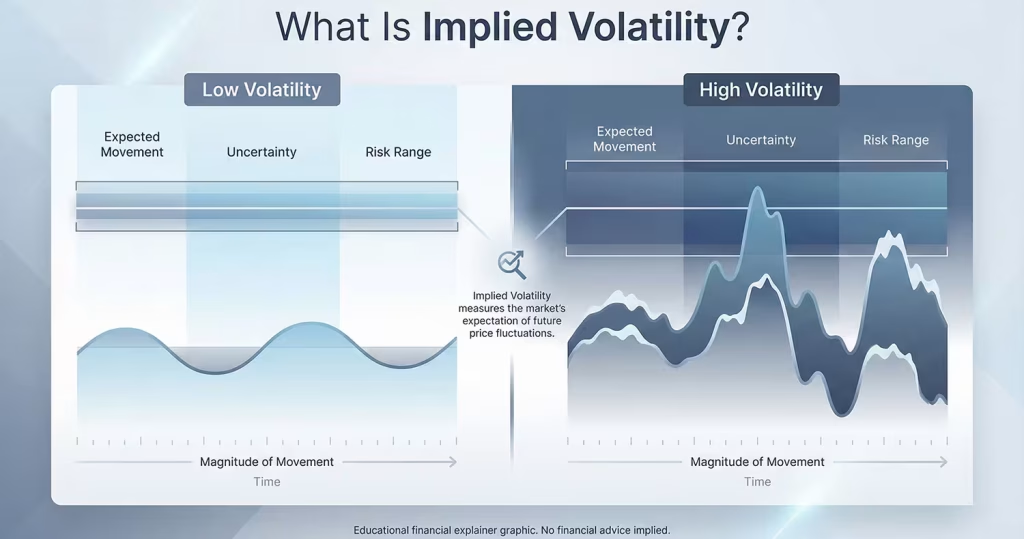

What Is Implied Volatility? (In Plain English)

Implied volatility sounds complicated because it comes from the options market—but the idea itself is simple.

Implied volatility (often shortened to IV) measures how much movement the market expects, not which direction that movement will go. It’s not a prediction of up or down. It’s a reflection of uncertainty.

High implied volatility means the market expects chaos. Big swings. Unexpected outcomes. The kind of environment where pricing mistakes can get expensive. Low implied volatility signals stability—conditions where outcomes are expected to stay within a tighter range.

Here’s the easiest way to think about it:

crossing a calm lake costs less than crossing a stormy ocean. Not because you won’t make it across, but because the risk along the way is higher.

That same logic applies to betting markets.

In options trading, IV rises before known uncertainty:

- Earnings announcements

- Federal Reserve decisions

- Economic data releases

- Major news events

Options become more expensive before those events happen because traders are paying for protection against unpredictability. If you want a deeper, technical breakdown of how implied volatility works in that world, this implied volatility explainer from OptionsTrading.org does an excellent job laying out the mechanics.

Sportsbooks operate under the same principles—even if they don’t use the same terminology.

When injuries are uncertain, weather is questionable, lineups are fluid, or game scripts are harder to model, sportsbooks quietly raise the price of participation. They do it through wider spreads, inflated totals, heavier juice, and faster line movement.

Implied volatility isn’t visible on a betting board—but it’s always there. And once you learn to recognize it, you start to see why some lines feel expensive before anything has actually gone wrong.

The Hidden Parallel: Sportsbooks Already Price Volatility

Sportsbooks don’t publish volatility metrics. They don’t label markets as “high IV” or “low IV.” But make no mistake—they price volatility into every line they hang.

They have to.

A sportsbook isn’t trying to predict the exact final score. It’s trying to survive uncertainty while managing thousands of moving parts: injuries, weather, sharp action, public bias, and correlated outcomes across markets. When uncertainty rises, the book’s pricing adjusts—not because the game suddenly became harder to predict, but because the cost of being wrong increased.

You can see volatility pricing show up in several subtle but consistent ways:

- Wider point spreads in games with unpredictable game scripts

- Inflated totals when pace, weather, or officiating variance is high

- Heavier juice on sides the book expects to attract lopsided action

- Tighter limits early, followed by rapid adjustment once sharp money appears

- Faster line movement, even before public betting volume increases

Compare a regular-season NFL game between two average teams to a playoff matchup. The talent gap might be similar, but the pricing isn’t. Playoff games carry more emotional money, more late-game variance, and more exposure for the book. Volatility rises—so the price rises with it.

College football rivalry games offer another clear example. Familiar opponents, emotional narratives, unpredictable coaching decisions, and aggressive play-calling all inject uncertainty. Sportsbooks respond by padding totals, shading spreads, and protecting themselves against outsized outcomes.

The key insight here is critical: sportsbooks aren’t reacting to outcomes—they’re reacting to risk environments.

Odds don’t simply answer the question, “Who’s better?” They answer a more important one: How dangerous is this market for us to price cheaply?

Once you recognize that sportsbooks already think like volatility traders, betting lines stop feeling arbitrary. They start to feel intentional. And that’s when you realize that the edge isn’t in predicting chaos—it’s in knowing when the market has already charged you for it.

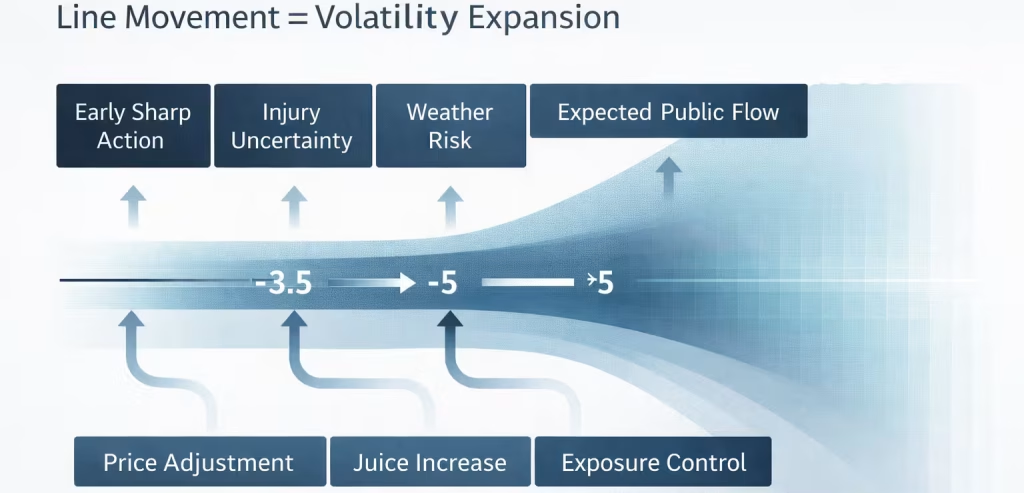

Line Movement Is Sports Betting’s Version of IV Expansion

In financial markets, volatility doesn’t announce itself. It shows up in pricing.

Sports betting works the same way.

When implied volatility rises in the options market, premiums increase, spreads widen, and prices adjust instantly. In sports betting, that same volatility expansion reveals itself through line movement—often before bettors fully understand why it’s happening.

Not all line movement is created equal. Some moves reflect real information. Others reflect anticipation of risk. And understanding the difference is where bettors gain an edge.

Why Lines Move Before the Public Notices Anything

One of the biggest misconceptions in sports betting is that lines move because bets are placed. In reality, lines often move because sportsbooks are reacting to potential future exposure, not just current action.

Lines move early when:

- Sharp bettors place informed wagers

- Injury or weather information is anticipated but not confirmed

- One-sided action is expected based on public tendencies

- Books are protecting against correlated risk across markets

- Other sportsbooks move defensively to avoid being picked off

This is why you’ll sometimes see a line shift without any obvious news breaking. The book isn’t responding to what already happened—it’s responding to what it expects might happen next.

That’s classic volatility pricing behavior.

Line Movement as a Signal of Volatility Expansion

When a market becomes unstable, sportsbooks adjust pricing faster and more aggressively. You’ll often see multiple changes clustered together rather than gradual shifts.

Common volatility-driven movement includes:

- Sudden half-point or full-point jumps

- Juice flipping from -110 to -120 or worse

- Totals creeping up despite no change in weather or pace

- Derivative markets (1H, team totals) moving independently of full-game lines

These moves aren’t about picking a winner. They’re about reducing risk during uncertain conditions.

Options Market vs. Sports Betting: Pricing the Same Risk

| Options Market Concept | Sports Betting Equivalent |

|---|---|

Implied volatility spike | Rapid line movement |

Wider bid-ask spreads | Heavier juice / shaded lines |

Gamma exposure | Book liability imbalance |

Market makers adjust pricing | Sportsbooks adjust odds |

Traders pay more to participate | Bettors pay worse prices |

This parallel matters because it explains why betting late often costs more. By the time the market stabilizes, volatility has already been priced in—and you’re paying the premium.

Sharp vs. Public Line Movement: A Critical Distinction

Not all movement is sharp-driven. Not all sharp movement is obvious.

Sharp-driven moves tend to:

- Happen early

- Occur at lower limits

- Move quickly and decisively

- Be respected across books

Public-driven moves tend to:

- Happen closer to game time

- Inflate favorites, overs, and popular teams

- Come with increased juice rather than clean number moves

Both types signal volatility—but for different reasons. The key is recognizing why the price is changing, not just that it is.

The Takeaway Bettors Miss

Line movement isn’t just information. It’s pricing behavior.

When lines move fast, the market is telling you something important: uncertainty is rising, and the cost of participation is going up with it. By the time movement feels “obvious,” volatility has already expanded—and the value has often disappeared.

Smart bettors don’t chase movement. They understand it.

Because in both sports betting and options trading, the worst time to buy risk is after everyone agrees it’s risky.

When Bettors Overpay for Volatility (And Don’t Realize It)

Volatility feels exciting. That’s the problem.

Games with uncertainty attract attention. They feel sharp. They feel “worth betting.” Sportsbooks understand this psychology better than anyone—and they price it accordingly.

When uncertainty rises, books don’t just widen spreads or move lines. They quietly raise the cost of participation. Bettors often mistake that higher price for increased opportunity, when in reality they’re paying a premium for chaos.

The Games That Quietly Cost More to Bet

Certain matchups consistently carry inflated pricing because sportsbooks know demand will be high regardless of value.

These include:

- Primetime games (Sunday Night Football, Monday Night Football, national TV showcases)

- Playoff and elimination games

- Rivalry matchups

- High-profile teams and star players

- Narrative-driven spots (revenge games, must-win scenarios)

- Weather-panic games, especially wind-heavy totals

In these environments, sportsbooks expect:

- Emotional money

- Late action

- Overreaction to storylines

- Chasing behavior

So they pad the numbers.

Totals creep higher. Favorites get shaded. Underdogs get juiced. Not because the outcome is clearer—but because bettors are willing to pay more to be involved.

How Overpriced Volatility Shows Up on the Board

You rarely see a sign that says “This line is expensive.” Instead, volatility shows up in subtler ways.

Common signals include:

- Extra juice with no new information

- Totals inflated beyond statistical baselines

- Half-point moves that favor the book, not the bettor

- Markets reacting more to hype than data

- Lines that feel ‘obvious’ or ‘safe’

When a bet feels too easy, it’s often because uncertainty has already been priced in—and you’re paying for it.

The Overs Trap: Paying Peak Volatility Prices

Overs are especially vulnerable to volatility overpricing.

High-profile games, fast-paced teams, and poor weather forecasts tend to inflate totals aggressively. Bettors chase points. Books collect premium pricing.

The issue isn’t betting overs—it’s betting overs after volatility peaks.

By the time the total feels unbettable, it usually is.

Why This Happens (And Why It’s Profitable for Sportsbooks)

Sportsbooks don’t need to trick bettors. They just need to:

- Anticipate behavior

- Price accordingly

- Let demand do the rest

Most bettors:

- Bet late

- Bet what’s visible

- Bet what feels urgent

That’s when volatility premiums are highest.

The house doesn’t win by being smarter about the game. It wins by being smarter about when bettors are willing to overpay.

Volatility itself isn’t bad. Overpaying for it is.

Sharp bettors don’t avoid chaotic games—they avoid expensive versions of them. They understand that uncertainty creates opportunity only before it becomes consensus.

Once highlighted, televised, and discussed, chaos stops being value and starts being tax.

And the market always collects.

When Volatility Actually Creates Betting Value

Volatility isn’t the enemy. Miscalculated volatility is.

The best betting opportunities don’t come from avoiding uncertainty—they come from stepping into it before the market fully adjusts. Value appears when risk exists, but the price hasn’t caught up yet.

This usually happens in quieter corners of the market, not the spotlight games.

Common situations where volatility creates opportunity:

- Early-season matchups, before true team identities are priced in

- New coaches or schemes, where historical data misleads the market

- Backup quarterback situations before limits rise or books fully react

- Injury uncertainty, when replacements are misunderstood or mispriced

- Smaller or derivative markets, where adjustments lag behind main lines

In these spots, uncertainty is real—but it’s not fully reflected in the number yet.

Sharp bettors don’t wait for clarity. They position themselves ahead of it, often targeting first halves, team totals, or alt lines where pricing is slower and volatility is unevenly distributed.

The moment volatility becomes obvious, it becomes expensive. The edge lives in the window before everyone agrees the game is risky—and prices it that way.

That’s where volatility stops being a cost and starts being an advantage.

Why Sharps Care More About Price Than Prediction

The biggest gap between casual bettors and sharps isn’t information—it’s perspective.

Casual bettors want to be right. Sharps want to be paid correctly.

Most bettors ask a simple question before placing a wager: Who’s going to win?

Sharp bettors ask a harder one: Is this price wrong relative to the risk?

That distinction matters because sports betting isn’t about forecasting outcomes—it’s about consistently buying mispriced probability. You can predict a game perfectly and still make a bad bet if the price already reflects that expectation.

This is why sharp bettors are comfortable with losing bets. A loss doesn’t automatically mean the decision was wrong. If the price beat the market—and especially if it closed in their favor—the wager still had positive expected value.

That concept is measured through Closing Line Value (CLV). CLV doesn’t guarantee wins, but over time it’s one of the most reliable indicators that a bettor is consistently finding value before the market corrects itself.

Sharps understand that:

- You can lose a well-priced bet

- You can win a poorly priced one

- Short-term results are noisy

- Long-term edges come from price discipline

This mindset also explains why sharps often pass on “obvious” games. When confidence is universal, volatility is priced aggressively and edges shrink. The sharper play is often doing nothing at all.

In the end, prediction satisfies ego. Pricing builds bankroll. And the bettors who survive long enough to matter learn to prioritize the latter.

How to Think Like a Volatility Trader as a Bettor

You don’t need a finance background to think like a volatility trader. You just need to shift how you frame risk.

Instead of asking whether a bet feels right, start asking whether it’s priced fairly for the uncertainty involved. That single adjustment changes how you approach every market.

Before placing a bet, slow down and run through a volatility-focused checklist:

- What is the market afraid of right now?

Injuries, weather, pressure, public narratives—fear drives pricing faster than logic. - Has uncertainty actually increased, or has attention increased?

These aren’t the same thing. Attention inflates prices. Real uncertainty doesn’t always. - Did new information enter the market—or is this recycled noise?

Sharp adjustments happen early. Late movement is often emotional. - Am I betting before clarity or after panic?

Value almost never appears once everyone agrees the game is “dangerous.”

Volatility-aware bettors also pay close attention to how prices move, not just where they land. Heavy juice without a clean number change, derivative markets moving faster than full-game lines, or totals inflating without statistical support are all signs the market is charging a premium.

Most importantly, volatility traders understand patience. Passing on a bet is a decision—not a failure. If the price reflects peak uncertainty, discipline is often the sharpest edge available.

The goal isn’t to avoid chaos. It’s to avoid overpaying for it.

Common Misconceptions That Cost Bettors Money

Most betting mistakes don’t come from bad analysis. They come from bad assumptions—ideas that sound logical but quietly erode long-term results.

These misconceptions are especially dangerous because they feel intuitive. And sportsbooks price against them relentlessly.

“More Uncertainty Means More Value”

This is one of the most persistent myths in betting.

Uncertainty creates opportunity only before it’s fully recognized. Once volatility becomes obvious, it becomes expensive. Sportsbooks don’t miss uncertainty—they charge for it.

If a game feels chaotic, unpredictable, or scary, the price almost always reflects that. By the time bettors feel compelled to “take advantage” of uncertainty, they’re often paying peak volatility premiums.

“Line Movement Always Equals Sharp Money”

Not all movement is informed.

Some line movement reflects:

- Expected public action

- Defensive book adjustments

- Narrative-driven betting patterns

- Late recreational money

Sharp-driven moves tend to happen early, at lower limits, and with purpose. Late movement often reflects emotion, not edge. Chasing it blindly usually means buying risk at the worst possible time.

“Big Games Are Easier to Predict”

High-profile games feel safer because information is abundant. In reality, those games are the most efficiently priced markets available.

More eyes mean:

- Fewer mistakes

- Faster corrections

- Less room for value

Add in emotional money and sportsbooks become even more conservative. The result is tighter numbers and higher costs—exactly the opposite of what bettors want.

“If the Line Didn’t Move, There’s No New Information”

Markets don’t always react with clean moves.

Sometimes new information shows up as:

- Increased juice

- Adjusted limits

- Defensive shading

- Quiet resistance at key numbers

Absence of movement doesn’t mean absence of adjustment. It often means the book is managing risk without inviting action.

“Odds Tell the Full Story”

Odds tell you the price—not the reason.

They don’t explain:

- Why the price is set

- What risk the book is protecting against

- How much uncertainty is already baked in

Bettors who read odds as opinions miss the most important layer of information: what the market is charging for risk.

The Real Cost of These Beliefs

Each misconception leads to the same outcome—overpaying for uncertainty while mistaking it for opportunity.

The sharper approach isn’t to outthink the game. It’s to outthink the pricing. And that starts by unlearning the assumptions sportsbooks count on bettors to keep making.

Conclusion: Sports Betting Isn’t Gambling — It’s Risk Pricing

Sportsbooks aren’t trying to predict outcomes. They’re trying to price uncertainty.

Every line you see is the result of risk management, not confidence. It reflects what the market fears, where money is expected to flow, and how dangerous it is for the book to offer a clean price. Once you understand that, betting odds stop feeling mysterious—and start feeling intentional.

Implied volatility gives us a useful framework for seeing what sportsbooks already see. When uncertainty rises, prices rise with it. When chaos becomes obvious, value usually disappears. And when everyone agrees a game is risky, the cost of being involved is already baked into the number.

The most consistent bettors don’t chase excitement or certainty. They focus on price discipline. They recognize when volatility is underpriced—and just as importantly, when it’s being sold at a premium. They’re comfortable passing on games that feel “too good,” knowing that patience is often the sharpest edge available.

In the end, betting success isn’t about predicting the future better than everyone else. It’s about understanding how risk is priced—and refusing to overpay for it.

Alyssa contributes sportsbook/online casino reviews, but she also stays on top of any industry news, precisely that of the sports betting market. She’s been an avid sports bettor for many years and has experienced success in growing her bankroll by striking when the iron was hot. In particular, she loves betting on football and basketball at the professional and college levels.