Prediction Markets & Event Contracts

Prediction markets are quietly changing how people think about the future.

Instead of betting against a sportsbook or trusting loud opinions on TV, these markets let everyday traders put real money behind real predictions — and watch probabilities update in real time as new information hits the market.

If that sounds a little like sports betting, investing, and polling all rolled into one, that’s because it is.

Platforms like Kalshi and Polymarket don’t use traditional odds. They use event contracts — simple “Yes” or “No” trades that reflect what the market believes will actually happen. When the crowd becomes more confident, prices rise. When doubt creeps in, prices fall. You’re not guessing against a house; you’re trading probabilities against other participants.

That difference matters.

It’s why regulators are paying closer attention. It’s why sportsbooks are watching carefully. And it’s why sharp bettors, traders, and even economists increasingly use prediction markets as a signal for truth — not hype.

This guide breaks down how prediction markets work, where you can trade event contracts, what’s legal (and what isn’t), and how smart users are already applying them alongside traditional betting. If you want a clearer, more transparent way to bet on the future, you’ll want to read on.

What Are Prediction Markets?

Prediction markets are marketplaces where people trade on the outcomes of real-world events.

Instead of placing a traditional bet with fixed odds, you’re buying and selling event contracts whose prices reflect the crowd’s best estimate of what will happen. The more likely an outcome seems, the higher the price of the contract. The less likely it becomes, the lower the price falls.

Think of prediction markets as live probability trackers powered by money.

Each market is built around a simple, clearly defined question, such as:

- Will a specific team win a championship?

- Will inflation exceed a certain level by a set date?

- Will a candidate win an election?

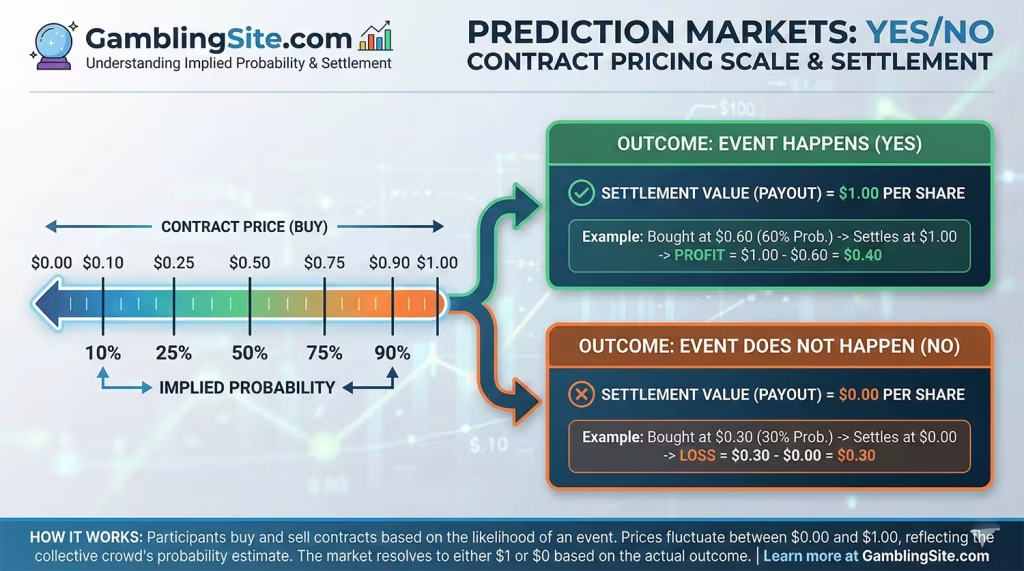

For each question, traders can buy “Yes” or “No” contracts. Those contracts trade between $0.00 and $1.00, with the price representing the market’s current belief about the likelihood of that outcome.

Why People Trust Prediction Markets

Prediction markets work because they aggregate information from many different participants, all with something at stake. When people put money behind their beliefs, weak opinions tend to fade and stronger information tends to rise.

That’s why prediction markets are often used to:

- Surface real-time public sentiment

- React faster than polls or media narratives

- Incorporate breaking news immediately

- Highlight mispriced probabilities

In many cases, they’ve proven more accurate than traditional forecasting methods.

How Event Contracts Actually Pay Out

The mechanics are intentionally simple.

- If the event happens, “Yes” contracts settle at $1.00

- If it does not happen, “Yes” contracts settle at $0.00

- “No” contracts settle in the opposite way

Your profit or loss is simply the difference between what you paid and where the contract settles — or where you sell it before settlement.

Since event contracts settle strictly based on predefined criteria, it’s worth understanding exactly how outcomes are determined and paid out before trading. If you want to learn more on how it all works, be sure to read through the following guide:

If sports betting is about beating the odds, prediction markets are about understanding — and trading — the probability itself.

Event Contracts vs. Sports Betting

At first glance, event contracts and sports betting can look almost identical. You’re risking money on an outcome. You win if you’re right. You lose if you’re wrong.

But once you get past the surface, the experience — and the incentives — are very different.

Sports betting is built around odds set by a bookmaker. Event contracts are built around prices set by the market itself. That single difference changes almost everything.

The Biggest Structural Differences

Here’s a simple way to think about prediction markets vs. traditional sportsbooks:

| Feature | Sports Betting | Event Contracts |

|---|---|---|

Pricing | Set by the sportsbook | Set by traders |

House Edge | Built into odds | No built-in edge |

Transparency | Limited | Fully visible |

Exit Early | Rare or restricted | Always possible |

Focus | Beating the book | Trading probabilities |

With sportsbooks, you’re always betting against the house. With event contracts, you’re trading against other participants.

Odds vs. Probabilities

Sportsbooks use odds to shape behavior.

They shade lines, limit sharp players, and move numbers to protect their edge. The odds you see aren’t just about probability — they’re about risk management.

Event contracts strip that away.

A contract priced at $0.72 simply means the market believes there’s roughly a 72% chance the event happens. There’s no hidden math, no vig baked into the number. The price is the probability.

For bettors who already think in implied odds, this feels refreshingly honest.

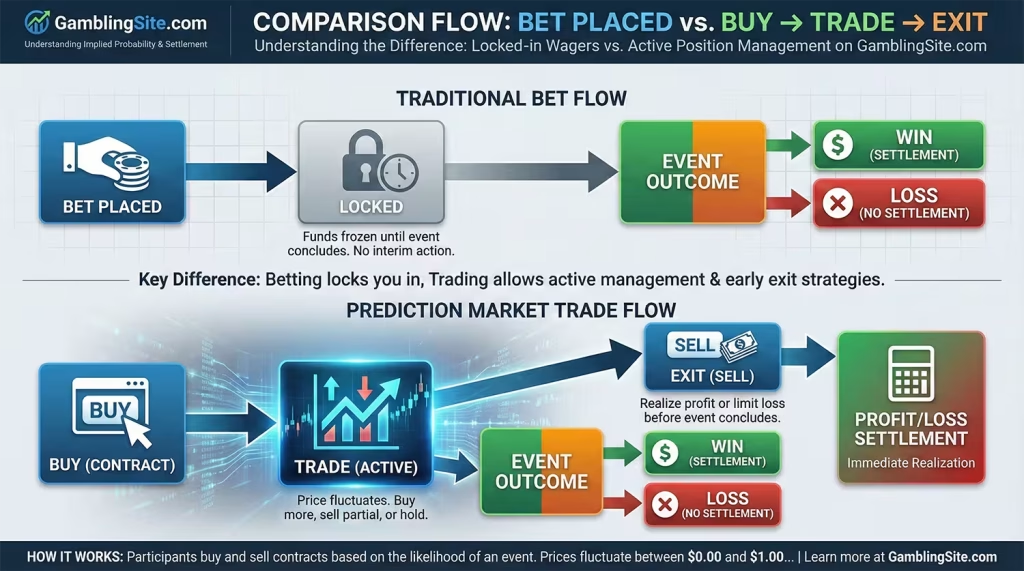

Exiting Positions Changes Everything

One of the most underrated differences is flexibility.

In sports betting:

- Once the bet is placed, you’re usually locked in

- Cash-out options (if available) are priced heavily against you

In event contracts:

- You can sell your position at any time

- You don’t need to wait for the event to finish

- You can lock in profit or cut losses early

That makes event contracts feel closer to trading than gambling.

Why Sportsbooks Don’t Love This Model

From a sportsbook’s perspective, prediction markets are uncomfortable.

They:

- Expose true market probabilities

- Reduce pricing power

- Remove the guaranteed house edge

- Encourage sharp participation instead of discouraging it

That’s why prediction markets aren’t just a novelty — they’re viewed as a potential threat.

Which Is Better?

It depends on what you value. Sports betting is familiar, fast, and widely available. Event contracts are transparent, flexible, and probability-driven.

Many serious bettors now use both — betting where odds are soft, and trading event contracts where probabilities feel mispriced.

Once you understand the difference, it’s hard not to see why prediction markets are gaining traction.

Where Can You Trade Event Contracts?

Right now, the event contracts space is still relatively small — but that’s part of the opportunity.

Unlike sports betting, where dozens of sportsbooks compete for attention, prediction markets are dominated by a handful of major platforms, each with a very different approach to regulation, risk, and market design.

Understanding where you’re trading is just as important as understanding what you’re trading.

The Two Main Types of Prediction Market Platforms

Most event contract platforms fall into one of two buckets:

- Regulated U.S. platforms: Operate under federal oversight, with strict rules on what markets can exist and how they settle.

- Crypto-based global platforms: Offer broader markets and deeper liquidity, but come with legal and regulatory trade-offs — especially for U.S. users.

Let’s look at the two names you’ll hear most often – Kalshi and Polymarket.

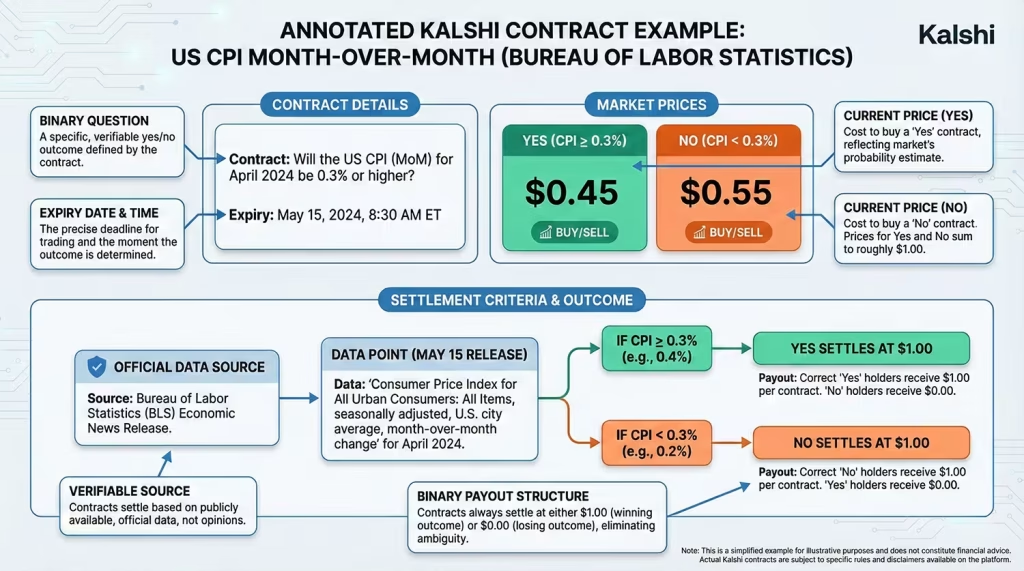

Kalshi

Kalshi is the most well-known U.S.-regulated event contracts platform.

It operates under the oversight of the Commodity Futures Trading Commission (CFTC), which means it treats event contracts more like financial derivatives than gambling products.

What Kalshi Is Known For

- Clear, well-defined contracts

- Strong regulatory footing

- U.S. dollar funding and withdrawals

- Markets tied to economics, politics, and select sports-related outcomes

Kalshi is often the entry point for users who care deeply about legality and regulatory clarity. The trade-off is that its market selection can be more limited than offshore or crypto-based platforms.

Best for: U.S. users who want a cleaner, lower-risk way to trade event contracts.

Polymarket

Polymarket is the most popular crypto-based prediction market in the world.

It runs on blockchain infrastructure and is known for:

- Extremely active markets

- Deep liquidity during major events

- Fast-moving prices that react instantly to news

You’ll find markets on everything from elections and sports to crypto protocol events and pop culture outcomes.

That said, Polymarket operates in a regulatory gray area for U.S. users, which is something readers should clearly understand before participating.

What Polymarket Does Well

- Broad market coverage

- Sharp price discovery

- Global participation

- Strong activity during high-profile events

Best for: Experienced users who understand crypto mechanics and regulatory risk.

How to Choose the Right Platform

Choosing where to trade event contracts isn’t just about popularity. It comes down to your priorities.

Ask yourself:

- Do I care more about regulatory clarity or market variety?

- Am I comfortable using crypto wallets?

- Do I want U.S. dollar funding and withdrawals?

- How important is liquidity for the markets I plan to trade?

Many users end up monitoring both types of platforms, even if they actively trade on only one.

Want the Full Breakdown?

We compare platforms side-by-side — including fees, liquidity, legal status, and who each one is best for — in our full rankings guide.

- Best Prediction Market Sites & Event Contract Platforms

Are Prediction Markets Legal and Safe?

This is the question almost everyone asks first — and for good reason.

Prediction markets sit in a strange space between betting, trading, and forecasting. That means legality and safety aren’t always as simple as “yes” or “no.” It depends on how the platform operates, where you live, and what type of contracts are being offered.

Let’s break both sides of this down clearly.

Are Prediction Markets Legal in the U.S.?

Some are. Some aren’t. And the difference matters.

In the United States, legality generally comes down to federal oversight, not state gambling laws. Certain event contracts are regulated by the Commodity Futures Trading Commission (CFTC), which oversees derivatives and futures markets.

Platforms that operate under this framework are treated more like financial exchanges than sportsbooks.

Others — particularly crypto-based prediction markets — may be legal in some jurisdictions, restricted in others, or unavailable to U.S. users altogether.

In Simple Terms

- CFTC-regulated platforms → legal to use in the U.S.

- Offshore or crypto platforms → may be restricted or unavailable to U.S. users

This is why two platforms that look similar on the surface can carry very different legal risk.

Are Prediction Markets Safe?

“Safe” can mean a lot of things, so it’s worth being specific.

Prediction market safety usually comes down to four core factors:

- Regulation & Oversight

Regulated platforms must follow strict rules around market integrity, settlement, and customer funds. - Settlement Clarity

Well-written contracts clearly explain how and when outcomes are resolved. Ambiguity is a red flag. - Counterparty Risk

On some platforms, you’re relying on the exchange to honor settlements. On others, smart contracts handle this automatically. - Platform Stability

Liquidity, uptime, and operational transparency all matter — especially during high-volatility events.

Key Safety Differences to Know

| Factor | Regulated Platforms | Crypto-Based Platforms |

|---|---|---|

Oversight | Federal regulators | Community / protocol rules |

Funds | Custodied by platform | Wallet-based |

Settlement | Defined by regulator | Defined by oracle |

Risk Profile | Lower | Higher, but flexible |

Why This Matters for Traders and Bettors

Legal and safety considerations don’t just protect you — they shape the types of markets available, how quickly you can withdraw, and what happens if something goes wrong.

That’s why understanding the platform before placing a trade is just as important as understanding the contract itself.

Prediction markets can be a powerful tool. But like any financial product, the smartest users start by knowing the rules of the game.

How to Trade Event Contracts (Beginner-Friendly)

If you’ve ever placed a sports bet, trading an event contract will feel familiar — but simpler than you might expect.

Instead of choosing odds, spreads, or totals, you’re making one core decision: Do you think an event will happen or not? From there, the market does the rest.

Event contracts are designed to be intuitive, even for first-time users. Prices move up and down as new information becomes available, giving you the option to react — not just wait.

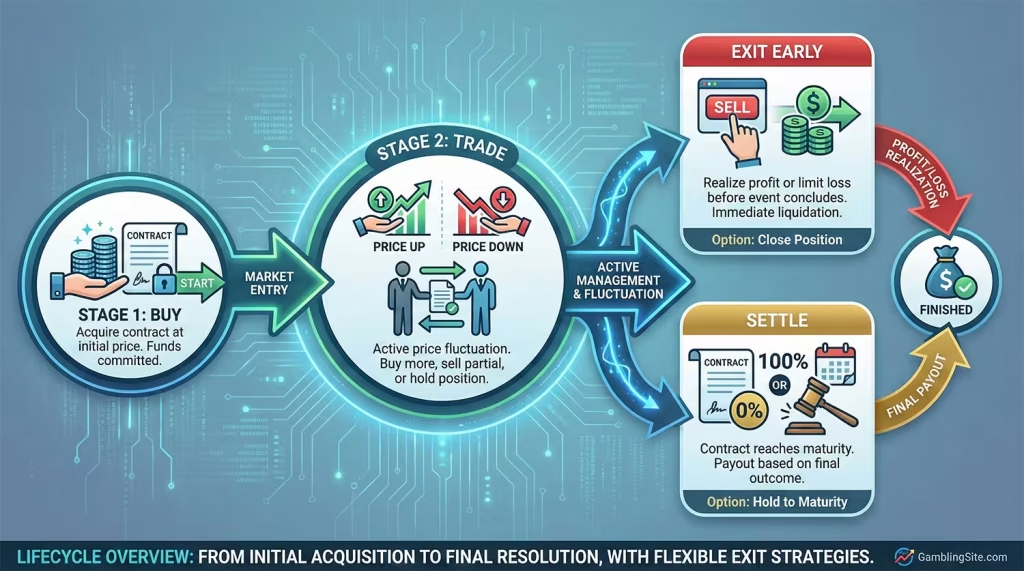

The Basic Process

At a high level, trading an event contract looks like this:

- Choose a platform

Select an event contracts platform that fits your comfort level with regulation, funding, and risk. - Read the contract carefully

Every market includes specific settlement criteria. Understanding exactly what counts as a “Yes” or “No” is critical. - Buy “Yes” or “No” shares

The price you pay represents the market’s current estimate of the event’s probability. - Manage your position

You can hold the contract through settlement or sell it early if the price moves in your favor — or against you. - Settle or exit

Contracts either settle at $1.00 or $0.00, or you close the trade before that happens.

That’s it. No parlays, no hidden juice, no complicated math. For a more detailed look into how all of this works, be sure to check out our step-by-step guide to how to trade event contracts.

Why Beginners Like Event Contracts

Many new users find event contracts easier than traditional betting because:

- Prices directly reflect probabilities

- You’re never locked into a position

- Profits and losses are straightforward

- You can respond to news in real time

Where beginners tend to struggle isn’t execution — it’s overtrading, ignoring liquidity, or misunderstanding contract wording.

We cover all of that in our full beginner guide for How to Trade Event Contracts.

Advanced Uses: Why Sharp Bettors Care

For casual users, prediction markets are an interesting alternative to betting.

For sharp bettors, they’re a tool.

The biggest difference is how event contracts can be used around traditional bets — not just instead of them. Because prices update continuously and positions can be exited at any time, prediction markets allow for strategies that sportsbooks simply don’t support.

Experienced bettors commonly use event contracts to:

- Hedge futures bets

Lock in profit or reduce downside without waiting for the final outcome. - Read true market sentiment

Event contract prices often reflect sharper consensus than sportsbook odds or public betting percentages. - Trade volatility instead of outcomes

Buy early when uncertainty is high, then sell when the market converges — even if the event hasn’t happened yet. - Expose mispriced probabilities

When sportsbooks lag or shade lines, prediction markets can reveal where value actually exists.

This flexibility is why many professional bettors and serious traders monitor prediction markets daily, even if they still place most of their action with sportsbooks.

You don’t need to abandon traditional betting to benefit. In fact, prediction markets work best when used alongside it.

We break down these strategies — with real examples and practical frameworks — in our dedicated article, How Smart Bettors Use Prediction Markets.

Prediction Markets Beyond Sports

While sports tend to get the most attention, they’re only one slice of what prediction markets can do.

In many ways, non-sports markets are where prediction platforms are at their most powerful. These events don’t have point spreads or moneylines, which means prices are driven almost entirely by information, sentiment, and real-world signals.

That’s why prediction markets are increasingly used to forecast outcomes like:

- Elections and political control

- Economic data releases (inflation, interest rates, jobs reports)

- Crypto and tech milestones

- Awards shows and pop culture events

In these markets, participants aren’t just guessing — they’re reacting to polling data, insider knowledge, macro trends, and breaking news as it happens. Prices adjust instantly, often faster than traditional forecasts or media narratives.

This has led to an interesting pattern: prediction markets frequently outperform polls and expert predictions, especially as events get closer to resolution.

For traders and bettors, these markets also offer something different:

- Less emotional bias than sports

- Clear, objective settlement rules

- Opportunities to trade information gaps rather than team performance

As prediction markets expand, their role as real-time forecasting tools is only getting stronger.

So… Are Prediction Markets Worth Paying Attention To?

Yes — and not because they’re trendy or controversial, but because they fundamentally change how outcomes are priced.

Prediction markets replace opinions with incentives. Instead of listening to experts argue or sportsbooks quietly shade lines, you’re watching real money react to real information in real time. That transparency is powerful, especially for anyone who already thinks in probabilities.

These markets aren’t perfect. Liquidity can be uneven. Regulation is still evolving. And not every platform is right for every user. But for bettors, traders, and curious analysts alike, prediction markets offer something traditional systems rarely do: an honest signal.

They don’t ask you to predict the future with certainty. They ask you to decide whether the market is right — or wrong.

That’s why sharp bettors use them to hedge futures, spot mispriced probabilities, and read sentiment before sportsbooks adjust. It’s why economists study them. And it’s why regulators are paying attention.

If you’re serious about understanding risk, value, and probability, prediction markets aren’t something to ignore. They’re something to learn — and, when used carefully, something to leverage.