Why Wild Card Weekend Is the Most Mispriced Week in NFL Betting

Wild Card Weekend feels like the sharpest betting week of the entire NFL season.

The games matter more. The mistakes feel costlier. Every matchup is isolated, dissected, debated, and blasted across every screen you own. For many bettors, this is the moment they’ve been waiting for—playoff football, real stakes, real opinions.

That’s exactly where the problem starts.

Every January, sportsbooks aren’t facing smarter bettors. They’re facing more emotional ones. Millions of casual and once-a-year bettors flood back into the market at the same time, all gravitating toward the same sides, the same stories, the same “can’t-miss” teams.

The result isn’t tighter lines. It’s distorted pricing.

Wild Card Weekend consistently produces some of the most mispriced numbers of the entire NFL calendar—not because sportsbooks lose control, but because they don’t need to be right. They just need to be protected.

Favorites get inflated. Totals creep upward. Narratives quietly replace numbers. And confidence rises faster than discipline.

If you understand why this happens—and where sportsbooks expect you to bet—Wild Card Weekend stops being chaotic. It becomes an opportunity.

Playoff Betting Feels Sharper—But It Isn’t

There’s a reason Wild Card Weekend feels different to bet.

The games are bigger. The analysis is louder. Every line is broken down from ten different angles before kickoff. To most bettors, that level of attention signals efficiency—surely the market has this figured out.

It hasn’t.

What changes in the playoffs isn’t the quality of pricing—it’s the composition of the market. Sportsbooks don’t suddenly switch to a more accurate model in January. They switch to a more defensive one.

During the regular season, lines are shaped by sharp money early and managed gradually throughout the week. In the playoffs, especially Wild Card Weekend, sportsbooks are preparing for something else entirely: volume without discipline.

Here’s what actually shifts when the postseason starts:

- A massive influx of casual bettors who haven’t wagered in weeks—or months

- Fewer games, which concentrates money on every matchup

- Heavier media influence that pushes public consensus faster

- Sportsbooks prioritizing exposure control over pure probability

The result is a subtle but important change: numbers are no longer trying to be right—they’re trying to be safe.

That’s why playoff lines often look “tight” but behave strangely. Spreads stretch just a bit too far. Totals sit slightly higher than expected. And small edges that would disappear in October quietly survive in January.

The market feels sharper because everyone is watching.

In reality, it’s just louder—and far easier to lean against if you know where to look.

Wild Card Weekend Brings the Worst Type of Betting Volume

Not all betting volume is created equal.

Sportsbooks don’t fear money—they fear one-sided money. And Wild Card Weekend delivers the most predictable, emotionally driven betting volume of the entire season.

This is the moment when:

- Casual bettors return after weeks (or months) away

- Office pools turn into sportsbook wagers

- “I just want action” replaces bankroll strategy

- Everyone is betting the same games at the same time

From the book’s perspective, this is the opposite of a healthy market.

Instead of sharp money pulling lines toward true probability, sportsbooks are dealing with waves of public bets that look nearly identical. That forces them to adjust numbers preemptively, not reactively.

Here’s what makes Wild Card betting volume uniquely problematic:

- Concentrated attention: Fewer games means every matchup absorbs massive handle

- Narrative alignment: Public bettors gravitate to the same favorites and stories

- Entertainment-driven bets: Parlays, Overs, and “fun” sides dominate ticket count

- Low price sensitivity: Bettors care more about being right than getting value

When that happens, sportsbooks don’t wait for imbalance—they anticipate it.

Spreads get shaded upward on popular teams. Totals inflate to absorb Over money. Numbers move not because information changed, but because sportsbooks know what’s coming next.

Wild Card Weekend isn’t chaotic for books. It’s scripted.

And when betting behavior becomes predictable, pricing becomes exploitable—if you’re willing to bet against the crowd instead of with it.

Narrative Inflation Is at Its Absolute Peak

Wild Card Weekend isn’t just about football—it’s about stories.

By the time the playoffs arrive, every team has a clean narrative arc. There are heroes, villains, redemption angles, and “destiny” teams that feel inevitable. And once those stories take hold, they start to move betting markets.

This is the week where perception quietly overwhelms price.

Turn on any pregame show and you’ll hear the same themes repeated until they feel like facts. The problem isn’t that these narratives are always wrong—it’s that they’re already baked into the line, and often then some.

Here are the most common Wild Card narratives that inflate numbers:

- “This team is hot right now” (small sample sizes dressed up as momentum)

- “You can’t fade this quarterback in the playoffs”

- “Playoff experience matters more than matchups”

- “This coach always finds a way in January”

- “Defense travels in the postseason” (applied selectively, not consistently)

Narratives feel sharp because they’re simple and confident. They give bettors a story to tell themselves about why a bet makes sense—without forcing them to ask whether they’re paying a premium for that comfort.

What actually happens is subtle but costly:

- Media repetition creates false consensus

- Social proof amplifies surface-level takes

- Public money follows belief, not efficiency

Sportsbooks don’t fight this. They price into it.

When a storyline becomes unavoidable, the number quietly stretches until the value is gone. The matchup hasn’t changed—but the cost of backing it has.

In Wild Card Weekend betting, stories don’t beat the spread.

They inflate it.

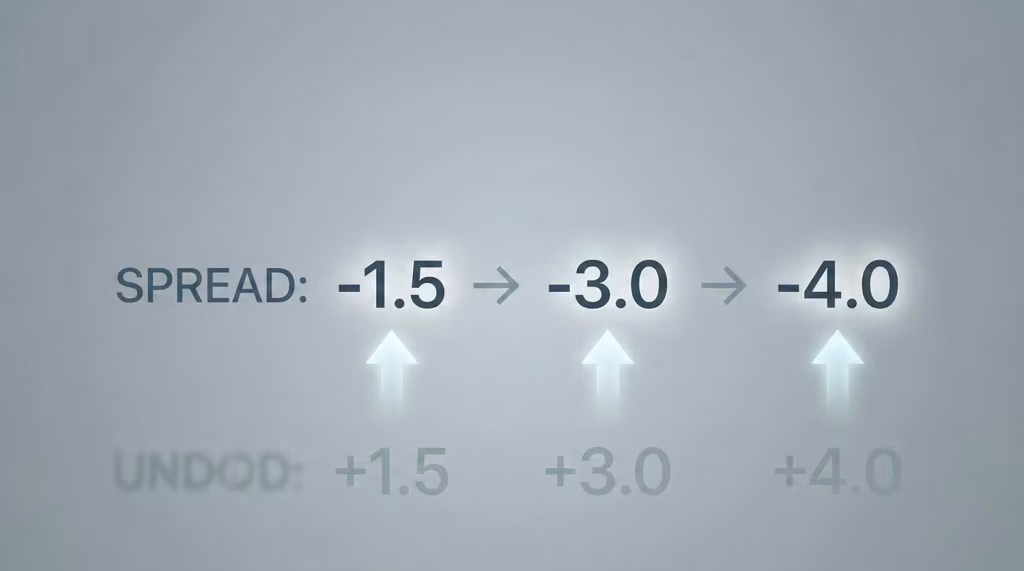

Why Favorites Are Routinely Overpriced

Wild Card Weekend favorites aren’t mispriced because they’re bad teams. They’re mispriced because they’re easy to bet.

This is the week where public confidence peaks. Bettors aren’t hunting for edges—they’re hunting for certainty. Favorites provide that illusion. They feel safer. Cleaner. More logical. And sportsbooks know exactly how that psychology plays out.

So the number quietly stretches.

A spread that might be -1.5 in October becomes -3 in January. A true toss-up turns into a “you just have to win by a field goal” situation. Nothing about the matchup changed—only the demand did.

Here’s why favorites get systematically overpriced during Wild Card Weekend:

- Public bias toward “better teams”: Winning records and playoff labels carry outsized weight

- Quarterback star power: Elite or well-known QBs attract blind loyalty

- Home-field exaggeration: January crowds are loud, but the edge is often overstated

- Fear of backing the ugly side: Casual bettors avoid teams with recent losses or flaws

Sportsbooks don’t need favorites to cover. They just need bettors to keep betting them.

That’s where value flips. When the favorite becomes expensive, the underdog doesn’t need to be great—it just needs to be misunderstood.

Short dogs, defensive teams, and “uninspiring” playoff entrants often get discounted simply because they don’t fit a clean story. But spreads don’t reward stories. They reward margins.

Wild Card Weekend favorites win plenty of games. They just don’t cover as often as their price suggests.

And that gap—between perception and probability—is where disciplined bettors quietly cash tickets while everyone else lays points they didn’t need to.

Totals Are Where the Biggest Mistakes Happen

If sides get shaded during Wild Card Weekend, totals get distorted.

This is where sportsbooks quietly find some of their safest margins—not because they know the final score, but because they know how bettors think. Playoff games feel bigger, faster, and more explosive, so the public naturally gravitates toward Overs.

The problem? January football rarely plays that way.

Why Overs Are So Easy to Sell in the Playoffs

Overs check every emotional box for casual bettors. They’re exciting. They stay alive until the final whistle. And they align perfectly with star-driven narratives.

But that popularity comes at a cost.

Here’s why Wild Card totals often open too high—or get pushed there quickly:

- Star offense bias: High-profile quarterbacks and skill players inflate expectations

- Highlight recency: Late-season shootouts linger in bettors’ minds

- Urgency myth: Playoff “must-win” pressure is assumed to create aggression

- Entertainment motivation: Overs are simply more fun to watch

Sportsbooks don’t fight this behavior—they price into it. Totals creep upward until Over bettors are paying a premium for optimism.

What Actually Happens on the Field

Wild Card games tend to be tighter, slower, and more conservative than expected—especially early.

Instead of fireworks, you often see:

- Scripted, cautious opening drives

- Coaches prioritizing field position over risk

- Defensive substitutions tightening in high-leverage spots

- Fewer explosive plays, more clock bleed

Add in cold weather, wind, and playoff nerves, and Overs lose their margin quickly.

Unders, on the other hand, rarely look comfortable—but they don’t need to. They just need inflated expectations to fall short.

That’s why totals are often the softest market during Wild Card Weekend. Not because sportsbooks guess wrong—but because the public guesses the same way, every year.

Why Line Movement Lies More This Weekend

One of the quickest ways bettors get misled during Wild Card Weekend is by treating all line movement as meaningful.

In the regular season, movement often reflects new information or sharp positioning. In the playoffs—especially this weekend—that assumption breaks down. The market is simply too loud.

Wild Card Weekend produces reactive movement, not informative movement.

Sportsbooks know exactly when public money is coming, where it’s going, and how aggressively it will hit certain teams. So they don’t wait for imbalance to appear—they move first.

Here’s why line movement becomes unreliable this week:

- Public-driven steam: Heavy ticket volume forces books to adjust before exposure becomes lopsided

- Defensive line shading: Numbers move to slow betting, not reflect probability

- Anticipated demand: Books move lines based on what they expect bettors to do next

- Narrative reinforcement: Media hype accelerates one-sided action and artificial movement

That creates a dangerous illusion. Bettors see a line move and assume “sharp money hit this side,” when in reality the move simply reflects popularity.

Sharps look at different signals:

- Early openers before narratives peak

- Key numbers that resist movement despite heavy action

- Juice changes that signal discomfort without overexposure

Late-week movement during Wild Card Weekend often says more about public enthusiasm than professional conviction.

The irony is that the most valuable information usually shows up before most bettors are paying attention.

By kickoff, the line has already told its story—and too often, bettors are reading it backward.

How Sharps Actually Bet Wild Card Weekend

Sharp bettors don’t treat Wild Card Weekend like a celebration. They treat it like a pricing problem.

While the public is focused on who’s “better,” sharps are focused on how much that belief costs. The goal isn’t to predict the playoffs perfectly—it’s to exploit the moments where emotion pushes the number too far.

This week, restraint matters more than conviction.

Here’s how sharp bettors typically approach Wild Card Weekend:

- They bet earlier in the week before narratives and public money stretch the line

- They care more about price than side, passing on games that feel “obvious”

- They prioritize underdogs, especially short dogs that cross key numbers

- They lean toward Unders, where inflated expectations create margin

- They isolate markets, preferring first-half or team-specific totals over full-game chaos

Just as important is what sharps avoid:

- Heavy favorites priced at a premium

- Parlays built on correlated narratives

- Chasing late steam without understanding the source

Another key difference is volume. Sharps don’t feel obligated to bet every game. Wild Card Weekend might offer six matchups—but only one or two clean prices. That’s enough.

While casual bettors see the playoffs as a time to bet more, sharps often do the opposite. They bet less, but with clearer edges. Because in January, the real advantage isn’t confidence.

It’s patience.

Why Sportsbooks Love This Weekend

From the outside, Wild Card Weekend looks like one of the most stressful stretches of the year for sportsbooks.

In reality, it’s one of the most predictable.

Sportsbooks aren’t guessing how bettors will behave this weekend—they’ve been watching the same patterns repeat every January for decades. The volume is massive, but the behavior is familiar, which makes risk easier to manage, not harder.

Here’s why Wild Card Weekend is so attractive to books:

- Unmatched betting handle: Few weekends bring more total wagers across so few games

- Highly concentrated action: Every dollar flows into the same small slate of matchups

- Consistent public tendencies: Favorites, Overs, and star quarterbacks dominate tickets

- Low price sensitivity: Bettors focus on being right, not on the number they’re laying

Because the action is so one-sided, sportsbooks can shade lines confidently. They don’t need perfect pricing—they need numbers that absorb public demand without exposing them to outsized risk.

Just as important, books know most bettors won’t adjust when the price changes. A favorite at -2.5 gets nearly the same action at -3.5. An Over bet doesn’t lose appeal because the total moved a point. That’s margin.

Wild Card Weekend isn’t when sportsbooks take chances. It’s when they let the market come to them. And when bettors mistake comfort for value, the house doesn’t need to win every game. It just needs the numbers to do their job.

Conclusion: Discipline Beats Excitement in January

Wild Card Weekend doesn’t punish bad handicapping. It punishes impatience.

This is the point in the season where confidence is loudest and discipline is quietest. Every game feels urgent. Every opinion feels sharpened by the word playoffs. And that urgency pushes bettors toward the same sides, the same totals, the same stories—often at the worst possible prices.

Sportsbooks don’t need to outthink bettors this weekend. They just need to understand them.

Favorites get inflated because they’re comfortable. Overs get pushed higher because they’re exciting. Line movement gets misread because bettors want confirmation instead of context. None of that means those bets can’t win—it just means you’re paying extra to feel right.

Wild Card Weekend rewards a different approach. It rewards bettors willing to pause when others rush. Willing to question when others agree. Willing to pass on games that feel obvious and wait for numbers that feel off.

You don’t beat this weekend by betting more. You beat it by betting better.

In January, the sharpest edge isn’t information. It’s restraint. And when everyone else is chasing certainty, restraint becomes the most valuable play on the board.

Alyssa contributes sportsbook/online casino reviews, but she also stays on top of any industry news, precisely that of the sports betting market. She’s been an avid sports bettor for many years and has experienced success in growing her bankroll by striking when the iron was hot. In particular, she loves betting on football and basketball at the professional and college levels.